About Loeb Smith

People

Sectors

Expertise

- Legal Service

- Banking and Finance

- Blockchain, Fintech and Cryptocurrency

- Capital Markets and Privatization

- Corporate

- Cybersecurity and Data Privacy

- Insolvency, Restructuring and Corporate Recovery

- Insurance and Reinsurance

- Intellectual Property

- Investment Funds

- Litigation and Dispute Resolution

- Mergers and Acquisitions

- Private Client and Family Office

- Private Equity and Venture Capital

- Governance, Regulatory and Compliance

- Entity Formation and Managed Services

- Consulting

- Legal Service

News and Announcements

Locations

Subscribe Newsletters

Contact

Introduction

In certain circumstances the official liquidator of a Cayman company may be able to take action to recover assets which have been transferred in the run up to the company’s insolvency. It is important for those concerned with the affairs of a Cayman company in the twilight of insolvency to be aware of the statutory powers available to the official liquidator and the Grand Court in the Cayman Islands.

Voidable preferences

Section 145(1) of the Companies Law (2016 Revision) (the “Law”) provides that every conveyance or transfer of property, or charge thereon, and every payment obligation and judicial proceeding, made, incurred, taken or suffered by any company in favour of any creditor at a time when the company is unable to pay its debts within the meaning of section 93 with a view to giving such creditor a preference over other creditors shall be invalid if made, incurred, taken or suffered within six (6) months immediately preceding the commencement of a liquidation.

Section 93 provides that a company shall be deemed to be unable to pay its debts if:

(a) it fails to comply with a statutory demand;

(b) the company fails to satisfy a judgment debt; or

(c) it is proven to the satisfaction of the Court that the company is unable to pay its debts.

Pursuant to section 100 of the Law, the compulsory winding up of a company is deemed to commence at the time of the presentation of the petition for the winding up or, in the case of a voluntary liquidation, at the time of the resolution or expiry of the relevant period or occurrence of an event provided by the company’s Articles of Association upon which the company is to be wound up.

It is important to note that a payment to a related party of a company shall be deemed to have been made with a view to giving a creditor a preference if made within the preceding period of six (6) months. Section 145(3) provides that a creditor shall be treated as a “related party” if it has the ability to control the company or exercises significant influence over the company in making financial and operating decisions.

Dispositions at an undervalue

Section 146(2) of the Law provides that every disposition of property made at an undervalue by or on behalf of a company with intent to defraud its creditors shall be voidable at the instance of its official liquidator. The official liquidator bears the burden of establishing an intent to defraud and no action may be brought under this section after six years following the date of the relevant disposition. A number of important definitions are set out in section 146(1):

(a) “disposition” has the meaning ascribed in Part VI of the Trusts Law (As Revised);

(b) “intent to defraud” means an intention to willfully defeat an obligation owed to a creditor;

(c) “obligation” means an obligation or liability (which includes a contingent liability) which existed on or prior to the date of the relevant disposition;

(d) “transferee” means the person to whom a relevant disposition is made and shall include any successor in title; and

(e) “undervalue” in relation to a disposition of a company’s property means:

(i) the provision of no consideration for the disposition; or

(ii) a consideration for the disposition the value of which in money or monies worth is significantly less than the value of the property which is the subject of the disposition.

However, the rights of the transferee are subject to some protection. Pursuant to section 145(5) of the Law in the event that any disposition is set aside under this section and the Court is subsequently satisfied that the transferee has not acted in bad faith:

(a) the transferee shall have a first and paramount charge over the property which is the subject of the disposition, of an amount equal to the entire costs properly incurred by the transferee in the defence of the action or proceedings; and

(b) the relevant disposition shall be set aside subject to the proper fees, costs, pre-existing rights, claims and interests of the transferee (and of any predecessor transferee who has not acted in bad faith).

Fraudulent Trading

Pursuant to section 147, if in the course of a winding up of a Cayman company it appears that any business of the company has been carried on with intent to defraud creditors of the company or creditors of any other person or for any fraudulent purpose the liquidator may apply to the Court for a declaration that any persons who were knowingly parties to the carrying on of the business in such a manner are liable to make such contributions, if any, to the company’s assets as the Court thinks proper.

This Briefing Note is not intended to be a substitute for specific legal advice or a legal opinion. For more specific advice on setting aside of antecedent transactions in the Cayman Islands, please contact:

Gary Smith

Ramona Tudorancea

Introduction

In line with the transparency and compliance efforts that made the Cayman Islands one of the early adopters of the Common Reporting Standard (CRS) and FATCA, the Cayman Islands introduced, with effect from 1st July 2017, a beneficial ownership regime (the “BO Regime”) which requires each company and limited liability company (LLC) to maintain a register of beneficial owners holding more than 25% of the interests in the company or LLC. The rules are set out in Part XVIIA (Beneficial Ownership Registers) of the Companies Law (2018 Revision) (the “Companies Law”). All companies and LLCs incorporated or registered by way of continuation in the Cayman Islands are collectively referred to herein as “Companies”.

In summary, a register is required to be created for Companies covered by the BO Regime, to be maintained at each company’s registered office in the Cayman Islands, in which beneficial ownership information is required to be kept current (the “BO Register”). Entries from the BO Register have to be periodically uploaded onto a centralized search platform (the “Beneficial Ownership Platform”) which is maintained by the Cayman Islands government authorities and accessible under certain conditions.

Determining which person(s) constitutes a “beneficial owner”

An individual is a “beneficial owner”[i] of a company or LLC if he/she holds, directly or indirectly:

(a) more than 25% of the shares in the company or interests in the LLC; or

(b) more than 25% of the voting rights in the company or LLC; or

(c) the right to appoint or remove a majority of the board of directors of the company or managers of the LLC.

If no person meets the conditions of (a), (b) or (c) above, then a person who has the absolute and unconditional legal right to exercise, or actually exercises, significant influence or control over the company or LLC (through the ownership structure or otherwise), other than solely in the capacity of a director, professional advisor or professional manager[ii], will be deemed a beneficial owner.

Which Companies are impacted by the BO regime?

Companies required to maintain a BO Register are mainly those that are not already subject to some form of direct regulatory oversight (e.g. subject to regulatory oversight in the Cayman Islands, U.S.A., China, U.K., E.U.) or indirect regulatory oversight (e.g. subject to regulatory oversight by a competent authority in an equivalent jurisdiction). In any case, limited partnerships and foreign companies will not be subject to the BO Regime.

Investment Funds and Investment Fund Managers

Effectively Companies which are structured as Cayman Islands investment funds, whether hedge funds or private equity funds, and general partners of private equity funds, real estate funds, or other investment funds, will not have to maintain a BO Register provided they fall within one of several exemptions contained in the Companies Law (e.g. the investment fund (i) is listed on a recognized stock exchange or (ii) has appointed a fund administrator that is licensed and regulated either in the Cayman Islands or in an equivalent legislation jurisdiction, or (iii) appointed an in-vestment manager that is licensed, registered and regulated either in the Cayman Islands or in an equivalent legislation jurisdiction, or (iv) appointed a sponsor that is licensed and regulated either in the Cayman Islands or in an equivalent legislation jurisdiction.

However Companies which are exempted are nonetheless required to file details outlining the ba-sis for their exemption from the requirement to file details of beneficial owners.

Obligation on each Cayman company:

-

- keep its beneficial ownership register at the company’s registered office;

- take reasonable steps to identify any individual who is a beneficial owner of the company;

- take reasonable steps to identify all relevant legal entities that exist in relation to the company.

A “relevant legal entity” is a legal entity that (a) is incorporated, formed or registered (including by way of continuation or as a foreign company) in the Cayman Islands; and (b) would be a beneficial owner of the company if it were an individual[iii].

Duty of beneficial owners and relevant legal entities to supply information

Where a “registrable person” (i.e. any beneficial owner and any relevant legal entity) knows that he or she is a beneficial owner of a Cayman company or a relevant legal entity and (i) has no reason to believe that the person’s required particulars are stated in the company’s beneficial ownership register, and (ii) the registrable person has not received a notice from the company in respect of its beneficial ownership obligations, the person shall:

(i) notify the company of the person’s status as a registrable person in relation to the company;

(ii) state the date, to the best of the person’s knowledge, on which the person acquired that status; and

(iii) give the company the required particulars.

Penalties and fines for failing to Comply

A company or LLC that knowingly and wilfully contravenes its obligations with respect to the BO Register will be liable:

(i) in the case of a first offence, to a fine of CI $25,000 (circa US $30,500); or

(ii) in the case of a second or subsequent offence, to a fine of CI $100,000 (circa US $122,000); and

(iii) Where a company is convicted of a third offence, the Cayman court may order that the company be struck off the register by the Registrar of Companies.

Directors and officers may be guilty of the same offence and liable to the same penalty if non-compliance happens with their consent or connivance, or is attributable to their wilful default.

Sanctions also apply to “registrable persons” that knowingly and wilfully fail to comply with the notice received from the company or LLC, or that knowingly and wilfully make a statement that they know to be false in a material particular, or recklessly make a statement that is false in a material particular. In this case, the sanctions are:

(i) on conviction on indictment:

(a) in the case of a first offence, to a fine of CI $25,000 (circa US $30,500); or

(b) in the case of a second or subsequent offence, to a fine of CI $50,000 (circa US $74,500) or to imprisonment for a term of two years, or to both;

(ii) on summary conviction, imprisonment for twelve months or a fine of CI$5,000 (circa US $6,100), or both.

Dealing with Non-Cooperative Shareholders

If the company or LLC does not receive the information from the registrable persons within a month of requesting them, a restrictions notice1 may be issued to the registrable persons whose particulars are missing, with a copy to the competent authority2. If the company or LLC has sent a restrictions notice3, then until it is withdrawn:

(i) any transfer or agreement to transfer the interest held by the person having received the restrictions notice, or to transfer a right to be issued with any shares, or a right to receive payment of any sums due from the company, is void (other than in a liquidation);

(ii) no rights are exercisable in respect of the interest (including the right to vote or appoint a proxy), no shares may be issued and, except in a liquidation, no payments may be made of sums due from the company, whether in respect of capital or otherwise; and

(iii) the BO Register will state ““restrictions notice issued” and the date of issue of the notice4.

Restrictions may be withdrawn by the company or LLC, if the company or LLC is satisfied with information and/or explanations received, or if the rights of a third party are being unfairly affected by the restrictions notice5. The restrictions may also be removed by the Court upon application by an interested party. Finally, a company or LLC may apply to the Court that interests subject to restrictions be sold, with the proceeds to be paid into the Court for the benefit of the beneficial owners6.

Confidentiality and Access to Information

Information regarding beneficial owners is protected under the Confidential Information Disclosure Law, 20167. The Beneficial Ownership Platform is accessible, however, by the Cayman Islands Government Minister with responsibility for Financial Services8 upon formal request by the Financial Intelligence Unit, the Financial Reporting Authority, the Cayman Islands Monetary Authority, the Tax Information Authority, or another body monitoring compliance with money laundering regulations9, or by the Financial Crime Unit of the Royal Cayman Islands Police Service in response to a request from a jurisdiction that has entered into an agreement with the Cayman Islands respecting the sharing of beneficial ownership information.

If you would like to discuss the application of the Beneficial Ownership regime to your particular Cayman Islands entity, please contact your usual Loeb Smith attorney or any of:

E: gary.smith@loebsmith.com

E: ramona.tudorancea@loebsmith.com

E: vivian.huang@loebsmith.com

E: yun.sheng@loebsmith.com

E: elizabeth.kenny@loebsmith.com

E: santiago.carvajal@loebsmith.com

[i] Section 247 of the Companies Law

[ii] Section 247(4) of the Companies Law

[iii] Section 248 of the Companies Law

1 Section 256(3) of the Companies Law

2 According to Section 246(1) of the Companies law, the competent authority is the Minister charged with responsibility for Financial Services.

3 Section 266(1) of the Companies Law

4 Section 7(2) of the Beneficial Ownership (Companies) Regulations, 2017

5 Section 273 of the Companies Law; in this case, the BO Register will state “restrictions notice withdrawn”.

6 Sections 271(1) and 272(1) of the Companies Law

7 Section 264 of the Companies Law

8 Section 260(1) of the Companies Law

9 Section 262(1) of the Companies Law

Introduction

In line with the transparency and compliance efforts that made the Cayman Islands one of the early adopters of the Common Reporting Standard (CRS) and FATCA, and which contributed to the continued success of the Cayman Islands as one of the premier offshore financial centres, an enhanced beneficial ownership regime will be implemented starting with 1st July 20171. The new rules are set out in a new Part XVIIA (Beneficial Ownership Registers) of the Companies Law (2016 Revision) (the “Companies Law”). The same rules also apply for limited liability companies (LLCs)2. All companies and LLCs incorporated or registered by way of continuation in the Cayman Islands are collectively referred to herein as “Companies”.

In summary, an additional corporate registry will be created for Companies covered by the new regime, to be maintained at each company’s registered office in the Cayman Islands3, in which beneficial ownership information will be required to be kept current (the “BO Register”). Entries from the BO Register will have to be periodically uploaded onto a centralized search platform (the “Beneficial Ownership Platform”) which will be maintained by the Cayman Islands government authorities and accessible under certain conditions. The following is a summary of the new regime, including some useful insights for our clients and partners.

1. Which Companies will be impacted by the new regime?

Companies required to maintain a BO Register will mainly be those that are not already subject to some form of direct regulatory oversight (e.g. subject to regulatory oversight in the Cayman Islands) or indirect regulatory oversight (e.g. subject to regulatory oversight by a competent authority in a Schedule 3 country). In any case, limited partnerships and foreign companies will not be subject to the new regime.

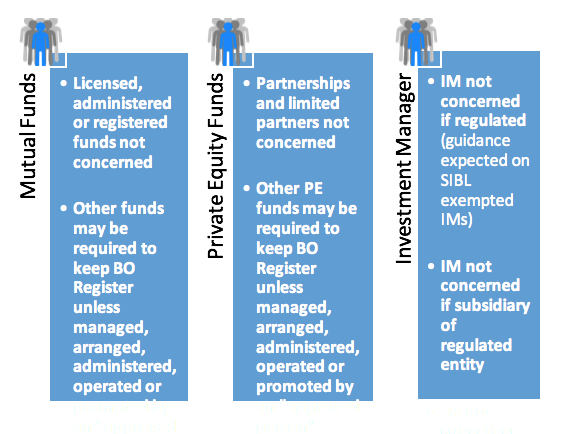

Investment Funds – Effectively Companies which are structured as Cayman Islands investment funds, whether hedge funds or private equity funds, and general partners of private equity funds, real estate funds, or other investment funds, will not have to maintain a BO Register provided they fall within one of several exemptions contained in the Companies Law.

Exemptions from the new BO Register regime – All Companies will be concerned4, except for those Companies which:

(a) are listed on the Cayman Islands Stock Exchange (CSX) or an “approved stock exchange”5;

(b) are registered or holding a licence under a “regulatory law”6 (regulatory law includes the Mutual Funds Law);

(c) are managed, arranged, administered, operated or promoted by an approved person as a special purpose vehicle, private equity fund, collective investment scheme or investment fund;

(d) are a general partner of a vehicle, fund or scheme referred to in paragraph (c) that is managed, arranged, administered, operated or promoted by an approved person; or

(e) are exempted by the Beneficial Ownership (Companies) Regulations, 2017.

In this context, “approved person” means a person or a subsidiary of a person that is regulated, registered or holding a licence in the Cayman Islands under a “regulatory law” or regulated in a jurisdiction listed in Schedule 3 of the Money Laundering Regulations (2015 Revision), or listed on the CSX or an “approved stock exchange”.

All exempted companies, ordinary non-resident companies and companies registered as special economic zone companies (SEZC) under the Special Economic Zones Law, 2011, are required to engage a corporate services provider (CSP) to assist them to establish and maintain their BO Registers7. Ordinary resident companies may either engage a CSP or the Registrar of Companies of the Cayman Islands may assist them8.

In practice, Cayman registered agents and other corporate services providers (CSPs) will be contacting and informing the Companies concerned of the new reporting obligations prior to 1st July 2017. For the investment funds industry, the Cayman Islands counsel may need to be involved in order to determine whether a fund, a general partner of a fund or an investment manager are subject to the requirement to keep a BO Register.

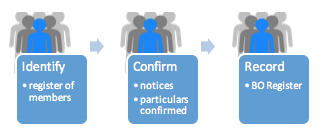

2. Requirement to take “Reasonable Steps” to identify Registrable Persons.

Companies required to maintain a BO Register will need to take reasonable steps to identify the individuals and the legal entities which fall under the definitions of beneficial owners and relevant legal entities.

In connection with the BO Register, Companies concerned are required to take “reasonable steps” to identify (i) any individual who is a beneficial owner of the company or LLC, and (ii) all relevant legal entities that exist in relation to the company or LLC. Together, (i) and (ii) are defined as “registrable persons”.

3. Determining which person(s) constitutes a “beneficial owner”

A person is a “beneficial owner”9 of a company or LLC if he/she holds, directly or indirectly:

(a) more than 25% of the shares in the company or interests in the LLC; or

(b) more than 25% of the voting rights in the company or LLC; or

(c) the right to appoint or remove a majority of the board of directors of the company or managers of the LLC.

If no person meets the conditions (a), (b) or (c) above, then a person who has the absolute and unconditional legal right to exercise, or actually exercises, significant influence or control over the company or LLC (through the ownership structure or otherwise), other than solely in the capacity of a director, professional advisor or professional manager10, will be deemed a beneficial owner.

A “relevant legal entity” is a legal entity that (a) is incorporated, formed or registered (including by way of continuation or as a foreign company) in the Cayman Islands; and (b) would be a beneficial owner of the company if it were an individual11. Foreign legal entities are therefore not registrable persons.

Further guidance is provided to help a company to identify its beneficial owners as follows:

Direct interest: To directly own shares, voting rights, or the right to appoint or remove any member of the board of directors, the right to exercise significant influence or control directly over the company, or to actually exercise significant influence, or the right to exercise, or to actually exercise, significant influence or control directly over the activities of a trust, partnership or other entity the trustees or members of which hold an interest in a company directly12.

Indirect interest: To have a majority stake in a legal entity which holds the shares or right directly or as part of a chain of other legal entities, with a “majority stake” defined as: (i) holding a simple majority of voting rights; or (ii) as a member, having the right to appoint or remove a simple majority of the board of directors; or (iii) as a member, controlling alone a simple majority of voting rights pursuant to a joint agreement with other shareholders or members; or (iv) having the right to exercise or exercising dominant direct influence or control13.

Joint Interest: If two or more persons each hold a share or right jointly, each of them is treated as holding that share or right. If shares or rights held by a person and shares or rights held by another person are the subject of a joint arrangement between those persons, each of them is treated as holding the combined shares or rights of both of them14.

4. A Step-by-Step Process.

Concerned Companies will need, starting with 1st July 2017, to maintain a BO Register. A specific step-by-step process of how companies should (i) identify (starting with the register of members but often looking beyond it), (ii) confirm, and (iii) record beneficial owners is detailed in the Companies Law and related Regulations. Specific instructions as to what the BO Register should include are also provided.

a. At first, it is expected that concerned Companies will be working on identifying any registrable persons. During this period of time, the BO Register should state “enquiries pending”.

b. If from the outset or following investigation, the company or LLC knows or has reasonable cause to believe that there is no registrable person, then the BO Register should state “no registrable person identified”.

c. Once the potential registrable persons are identified, the concerned company or LLC is required to give them notice15 in writing, asking them, within one month of the date of receipt of the notice:

(a) to confirm whether or not they are registrable persons; and

(b) if they are registrable persons, to confirm or correct any required particulars that are included in the notice and supply any required particulars that are missing.

During this period of time, the BO Register should state “confirmations pending”.

What “particulars” are required?

The following information, once confirmed, will be required to be provided by each company and LLC to the CSP (or the Registrar, as the case may be), to be entered into the BO Register:

– for an individual16, the full legal name, residential address and, if different, an address for service of notices, date of birth, information identifying the individual from their passport, driver’s licence or other government-issued document, including identifying number, country of issue and date of issue and of expiry;

– for a corporation sole, a government or government department of a country or territory or a part of a country or territory, an international organization whose members include two or more countries or territories (or their governments), or a local authority or local government body17, name, principal office, and the legal form of the person and the law by which the person is governed; and

– for a relevant legal entity18, the corporate or firm name, the registered or principal office, the legal form of the entity and the law by which it is governed, the register of companies in which it is entered and its registration number (if applicable),

In each case, the date on which the individual or entity became or ceased to be a registrable person is also required.

If the company or LLC has not identified all potential registrable persons but knows or has reasonable cause to believe that a shareholder or another legal entity knows the identity of a registrable person19, the company or LLC may also give notice to these persons, asking them:

(a) to state whether or not they know the identity of a registrable person or any person likely to have that knowledge; and

(b) if so, within one month of receipt of the notice, to supply, at the expense of the company, any required particulars respecting such registrable persons that are within the addressee’s knowledge, and to state whether the particulars are being supplied with or without the knowledge of the person concerned.

Finally, a company is not required to give a notice if:

(a) the company knows that the individual or entity is not a registrable person; or

(b) the company has already been informed of the individual’s or entity’s status as a registrable person in relation to it, and has received all the required particulars.

d. Particulars are deemed confirmed and the notices process stops20 when the company has reasonable grounds to believe that:

(i) the particulars were supplied or confirmed by the individual or entity to whom the particulars relate; or

(ii) if another person supplied or confirmed the particulars, this was done with the knowledge of the individual or entity to whom the particulars relate; or

(iii) if the particulars were included in a statement of initial significant control delivered to the Registrar by subscribers wishing to form a company.

In general, it is accepted that a company will be entitled to rely, without further enquiry, on the response of a person to a notice in writing sent in good faith by the company, unless the company has reason to believe that the response is misleading or false21.

e. If a company or LLC becomes aware of a relevant change, with respect to a registrable person or its particulars, which would cause the company’s BO Register to be materially incorrect or incomplete, then the company is required to give notice to the registrable person requesting confirmation of the change22. If the change is confirmed, the BO Registrar will need to be updated accordingly.

It should be noted that details of a previous registrable person can only be deleted from the BO Register after the expiration of five years from the date on which the person ceases to be a registrable person23.

f. If a mistake is made, any person listed as a registrable person in relation to the company may apply to the Grand Court24 for rectification of the company’s BO Register.

5. Compliance Issues.

Concerned Companies will have a one year “grace period” commencing on 1st July 2017 during which they are required to work with the relevant Cayman registered agent in order to identify registrable persons and create the BO Register before sanctions are applicable.

Reminder: If the Companies fail to comply with its obligations without reasonable excuse or makes a statement that is false, deceptive or misleading in respect of a material particular in the BO Register, the CSP helping the company or LLC to maintain the BO Register is required to give notice to the company or LLC25, and the company or LLC is then required to provide the missing particulars, as well as a justification or correction of any statements identified as false, deceptive or misleading.

Sanctions: After 1st July 201826, a company or LLC that knowingly and wilfully contravenes its obligations with respect to the BO Register will be liable to a fine of CI$25,000 (US$30,487.80), plus CI$500 (US$609.76) for each day during which the offence continues, up to a maximum of CI$25,000 (US$30,487.80)27. Directors and officers may be guilty of the same offence and liable to the same penalty if non-compliance happens with their consent or connivance, or is attributable to their wilful default28. Sanctions also apply to registrable persons that knowingly and wilfully fail to comply with the notice received from the company or LLC, or that knowingly and wilfully make a statement that they know to be false in a material particular, or recklessly make a statement that is false in a material particular. In this case, the sanctions are imprisonment for two years or a fine of CI$10,000 (US$12,195.12), or both (or, on summary conviction, imprisonment for twelve months or a fine of CI$5,000 (US$6,097.56), or both)29.

Dealing with Non-Cooperative Shareholders: If the company or LLC does not receive the information from the registrable persons within a month of requesting them, a restrictions notice30 may be issued to the registrable persons whose particulars are missing, with a copy to the competent authority31. If the company or LLC has sent a restrictions notice32, then until it is withdrawn:

(i) any transfer or agreement to transfer the interest held by the person having received the restrictions notice, or to transfer a right to be issued with any shares, or a right to receive payment of any sums due from the company, is void (other than in a liquidation);

(ii) no rights are exercisable in respect of the interest (including the right to vote or appoint a proxy), no shares may be issued and, except in a liquidation, no payments may be made of sums due from the company, whether in respect of capital or otherwise; and

(iii) the BO Register will state “restrictions notice issued” and the date of issue of the notice33.

Restrictions may be withdrawn by the company or LLC, if the company or LLC is satisfied with information and/or explanations received, or if the rights of a third party are being unfairly affected by the restrictions notice34. The restrictions may also be removed by the Court upon application by an interested party. Finally, a company or LLC may apply to the Court that interests subject to restrictions be sold, with the proceeds to be paid into the Court for the benefit of the beneficial owners35.

6. Confidentiality and Access to Information.

Information regarding beneficial owners is protected under the Confidential Information Disclosure Law, 201636. The Beneficial Ownership Platform will be accessible, however, by the Cayman Islands Government Minister with responsibility for Financial Services37 upon formal request by the Financial Intelligence Unit, the Financial Reporting Authority, the Cayman Islands Monetary Authority, the Tax Information Authority, or another body monitoring compliance with money laundering regulations38, or by the Financial Crime Unit of the Royal Cayman Islands Police Service in response to a request from a jurisdiction that has entered into an agreement with the Cayman Islands respecting the sharing of beneficial ownership information. Currently, only the UK is deemed to be such a jurisdiction.

This is not intended to be a substitute for specific legal advice or a legal opinion.

1. The Beneficial Ownership (Companies) Regulations, 2017, the Companies (Amendment) Law, 2017, the Companies Management (Amendment) Law, 2017, Limited Liability Companies (Amendment) Law, 2017, Beneficial Ownership (Limited Liability Companies) Regulations, 2017, are scheduled to become effective on 1st July 2017.

2. Limited Liability Companies (Amendment) Law, 2017, Beneficial Ownership (Limited Liability Companies) Regulations, 2017, the provisions of which are fairly similar.

3. Section 252(1) of the Companies Law

4. Section 245 of the Companies Law

5. As listed in Schedule 4 of the Companies Law

6.Section 2 of the Monetary Authority Law (2016 Revision), which refers to (i) Banks and Trust Companies Law (2013 Revision); (ii) Building Societies Law (2014 Revision); (iii) Companies Management Law (2003 Revision); (iv) Cooperative Societies Law (2001 Revision); (v) Insurance Law, 2010; (vi) Money Services Law (2010 Revision); (vii) Mutual Funds Law (2015 Revision); and (viii) Securities Investment Business Law (2015 Revision).

7. Section 252(2) of the Companies Law

8. Section 252(3) of the Companies Law

9. Section 247 of the Companies Law

10. Section 247(4) of the Companies Law

11. Section 248 of the Companies Law

12. Section 11 of the Beneficial Ownership (Companies) Regulations, 2017

13. Sections 12-13 of the Beneficial Ownership (Companies) Regulations, 2017

14. Section 15 of the Beneficial Ownership (Companies) Regulations, 2017

15. Section 249(1) of the Companies Law

16. Section 254(1) of the Companies Law

17. According to Section 244(2) of the Companies Law, such entities should be treated as an individual for the purposes of determining if they are a beneficial owner.

18. Section 254(3) of the Companies Law

19. Section 249(3) of the Companies Law

20. Section 254(4) of the Companies Law

21. Sections 247(2) and 248(2) of the Companies Law

22. Section 255(1) of the Companies Law

23. Section 258 of the Companies Law

24. Section 259 of the Companies Law

25. Section 256(1) of the Companies Law

26. Section 5 of the Companies (Amendment) Law, 2017

27. Section 274 of the Companies Law

28. Section 278 of the Companies Law

29. Sections 275 and 276 of the Companies Law

30. Section 256(3) of the Companies Law

31. According to Section 246(1) of the Companies law, the competent authority is the Minister charged with responsibility for Financial Services.

32. Section 266(1) of the Companies Law

33. Section 7(2) of the Beneficial Ownership (Companies) Regulations, 2017

34. Section 273 of the Companies Law; in this case, the BO Register will state “restrictions notice withdrawn”.

35. Sections 271(1) and 272(1) of the Companies Law

36. Section 264 of the Companies Law

37. Section 260(1) of the Companies Law

38. Section 262(1) of the Companies Law

What impact has the introduction of the new Cayman LLC had since it was introduced in 2016?

The Limited Liability Companies Law, 2016 (the LLC Law) introduced a new Cayman Islands limited liability company (the Cayman LLC) in June 2016. Since then, there has been an increasing number of Cayman LLCs formed and also some that have transferred to the Cayman Islands by way of continuation from other jurisdictions. According to records held by the Cayman Islands Registrar of Companies, between the period 1 July 2016 to 19 May 2017 there were 391 Cayman LLCs formed and another 16 transferred by way of continuation from other jurisdictions. The Cayman LLC has so far been proven attractive for general partner entities and other carried interest distribution vehicles. The Cayman LLC has the benefit of being (like a Cayman Islands exempt company) a separate corporate entity with limited liability but does not have the maintenance of capital restrictions applicable to exempt companies, and therefore has more flexibility to make distributions of income and capital through the terms of the LLC agreement. For the same reason, Cayman LLCs are also proving attractive for management company entities.

What are the key features of a Cayman LLC?

The key features are:

An LLC formed under the LLC Law is similar in structure to the Delaware LLC as the LLC Law is broadly based on the Limited Liability Company Act in the State of Delaware. However, the LLC Law has also preserved the broad legal principles applicable to Cayman Islands companies and the rules of equity and common law.

A Cayman LLC is a corporate entity which has legal personality separate from that of its members.

Formation of a Cayman LLC is straightforward. It requires the filing of a registration statement with the Companies Registry and payment of the requisite government fee. A Cayman LLC must have at least one member. It can be member managed (by some or all of its members) or the LLC agreement can provide for the appointment of persons (who need not be members) to manage and operate the Cayman LLC.

Profits and losses of a Cayman LLC are allocated among its members, and among classes of LLC interests or groups of members, in accordance with the terms of the LLC agreement.

Distributions of cash or in kind are made or paid among the members, and among classes of LLC interests or groups of members, in accordance with the terms of the LLC agreement.

The liability of an LLC’s members is limited. Members can have capital accounts and can agree among themselves (in the LLC agreement) how the profits and losses of the Cayman LLC are to be allocated and how and when distributions are to be made (similar to a Cayman Islands exempt limited partnership).

A Cayman LLC may be formed for any lawful business, purpose or activity and it has full power to carry on its business or affairs unless its LLC agreement provides otherwise.

Access to and the confidentiality of information and records of the Cayman LLC can be governed by the terms of the LLC agreement.

An LLC agreement may, among other things:

provide for classes or groups of managers having such relative rights, powers and duties as the LLC agreement may provide, and may make provision for the future creation of additional classes or groups of managers having such relative rights, powers and duties as may from time to time be established;

provide for the taking of an action, including the amendment of the LLC agreement, without the vote or approval of any manager or class or group of managers, including an action to create under the provisions of the LLC agreement a class or group of LLC interests that were not previously outstanding;

may grant to all or certain identified managers or a specified class or group of the managers the right to vote, separately or with all or any class or group of managers or members, on any matter.

The following statutory registers are required to be maintained for a Cayman LLC but, similarly to the requirement for a Cayman Islands exempted company, only an LLC’s register of managers is required to be filed with the Companies Registry:

a register of members;

a register of managers; and

a register of mortgages and charges.

The register of managers and register of mortgages and charges are required to be maintained in a manner similar to the register of directors and register of mortgages and charges for a Cayman Islands exempt company.

Subject to any express provisions of an LLC agreement to the contrary, a manager of the LLC will not owe any duty (fiduciary or otherwise) to the LLC or any member or other person in respect of the LLC other than a duty to act in good faith in respect of the rights, authorities or obligations which are exercised or performed or to which such manager is subject in connection with the management of the LLC provided that such duty of good faith may be expanded or restricted by the express provisions of the LLC agreement.

How, if at all, will Delaware law influence the development of the law governing the Cayman LLC?

While the Cayman LLC is loosely based on the Delaware LLC, it is worth noting that the legal traditions in both jurisdictions are different. Section 3 of the LLC law states that: “The rules of equity and of common law applicable to companies registered in the islands, as modified by the Companies Law and any other laws in force in the islands applicable to such companies, shall apply to a limited liability company, except in so far as such rules and law or modifications thereto are inconsistent with the express provisions of this law or the nature of a limited liability company…”

The development of the jurisprudence for Cayman LLCs is likely to be different in a number of respects from Delaware law because the rules of equity and of English common law, as is applicable in the Cayman Islands will be applied rather than Delaware law. By way of example, section 26(4) of the LLC law states that:

“Subject to any express provisions of an LLC agreement to the contrary, a manager shall not owe any duty (fiduciary or otherwise) to the limited liability company or any member or other person in respect of the limited liability company other than a duty to act in good faith in respect of the rights, authorities or obligations which are exercised or performed or to which such manager is subject in connection with the management of the limited liability company provided that such duty of good faith may be expanded or restricted by the express provisions of the LLC agreement.”

The duty to act in “good faith” in section 26(4) of the LLC law is a new statutory duty rather than an existing common law duty. The concept of “good faith and fair dealing” in Delaware law is an implied contractual duty. Delaware law allows for an LLC agreement to restrict, limit or exclude liabilities for breach of contract and breach of duties to the extent such breach does not constitute a bad faith violation of the implied contractual covenant of good faith and fair dealing. However, English common law applicable in the Cayman Islands does not recognise a general implied duty of good faith in contracts, and therefore the concept of “good faith” under section 26(4) is likely to be construed differently by the Cayman courts.

We expect that over the next few years Cayman LLCs might also prove attractive as a structure for offshore investment funds – especially private equity funds and real estate fund.

What are the possible uses of a Cayman LLC?

Owing to the additional flexibility that clients will have in using Cayman LLCs, going forward we see it being used for holding companies, joint venture entities and other special purpose vehicle (SPV) entities.

Investment feeder fund: The Cayman LLC has a number of features which lends itself to being a good fit for offshore investment funds. It is a corporate entity which has separate legal personality from that of its members, it has capacity to sue and to be sued in its own name, and it has the power and ability to acquire, hold and dispose of assets in its own right (as contrasted with a Cayman LP). The LLC Law has created a framework for Cayman LLCs to maximise the flexibility of operating through the terms of the LLC agreement. For example, pass-through treatment of profits and losses for tax purposes; and more flexibility to make distributions of income and capital through the terms of the LLC agreement by removing the maintenance of capital restrictions applicable to exempt companies. By way of contrast with LLCs formed in Delaware, which have traditionally been used as a general partner for Delaware limited partnerships, for carried interest distribution vehicles, and as management companies, but not as investment funds, we expect that over the next few years Cayman LLCs might also prove attractive as a structure for offshore investment funds (especially private equity funds and real estate funds, where we have already advised clients on funds structured as Cayman LLCs). There are a number of reasons for this: (i) using the Cayman LLC means having one entity rather than two entities when a limited partnership with its GP is used; (ii) using a Cayman LLC will be just as flexible as a limited partnership structure and therefore allow clients to align the rights of investors between onshore and offshore investment funds in master/feeder structures.

General Partners and Management Companies: the Cayman LLCs that have been formed to date have been predominantly general partners of limited partnerships and management companies and we expect this trend to continue for the reasons outlined above.

Gary Smith is a partner in the Corporate and Investment Funds Group at Loeb Smith Attorneys. He is an expert on Cayman Islands Investment Funds law and has given expert evidence in the US Federal Bankruptcy court relating to Cayman investment funds. He is also author of many legal articles including US Court and Cayman Islands Court: Sharing Jurisdiction in the Interests of Comity, published in International Corporate Rescue Vol. 12 (2015) Issue 1; and Fiduciary duties of a general partner of a Cayman exempted limited partnership published in Practical Law Global Guide 2015/16 – Private Equity and Venture Capital.

Gary Smith

Partner

Introduction

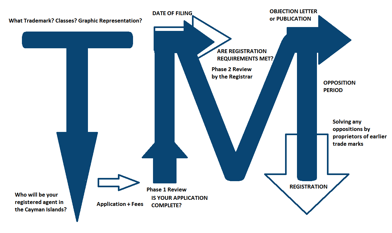

In the third issue of our series of legal insights on owning intellectual property (IP) through a Cayman Islands corporate structure, we discussed the new Cayman Islands Trade Marks Law published on 19th December 2016, pursuant to which a stand-alone comprehensive trademark protection regime was created in the Cayman Islands (the “New Trade Marks Regime”) to replace the current system of extension of existing UK/EU IP rights. After a few months of waiting, the Trade Marks Regulations, 2017 (the “Regulations”) were finally published on 26th May 2017, and the new regime is now scheduled to become effective 1st August 2017. In this new issue, we include a brief overview of the new trademark registration process.

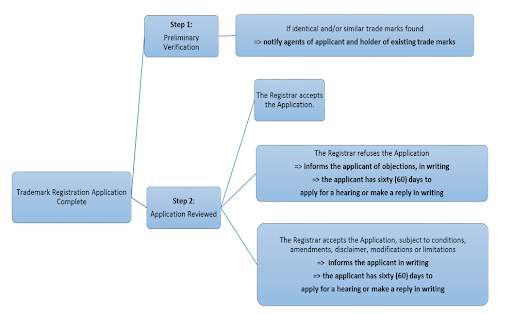

New Trademark Registration Process:

Preliminary Verifications: After receiving the completed application for the registration of a new trade mark, the Registrar will search the record of registered marks and pending applications, to determine if, in respect of the goods or services for which registration has been requested, there are any marks which are identical with, or nearly resembling the mark applied for, which are likely to deceive or cause confusion1. If any such marks are identified, they may constitute relative grounds for refusal of registration2 and the Registrar will notify the agents of both the applicant and of the holder of the earlier mark. Under the New Trade Marks Regime, identical or similar trade marks cannot be registered for similar goods or services, while similar trade marks may be registered subject to the consent of the holder of the earlier mark3 or upon the applicant showing honest concurrent use of the mark for which registration is sought4 . In addition, the Registrar will not accept marks which take unfair advantage of, or are detrimental to, the character or the repute of an earlier similar mark registered or otherwise protected in the Cayman Islands5.

Substantive Trade Mark Review: The Registrar will refuse a trade mark6 which lacks distinctive character, which is customary in the current language or the established practices of the trade, or which designates characteristics of goods or services (kind, quality, quantity, purpose, value, geographical origin, time of production, etc.). A mark will also not be registered if it may deceive the public as to the nature, quality, geographical origin or other characteristics of the goods or services. Finally, the Registrar is prohibited7 from registering the words “Cayman”, “Cayman Islands”, “Grand Cayman”, “Cayman Brac”, “Brac” or “Little Cayman”, or marks contrary to public policy or accepted principles of morality in the Cayman Islands. After the preliminary verifications and the substantive review, the Registrar may:

accept the application;

object to the application; or accept the application subject to certain conditions or limitations.

If an applicant is informed by the Registrar in writing of any objections, conditions, amendments, disclaimer, modifications or limitations, then the applicant will have sixty days (60) from receiving the notification from the Registrar to either apply for a hearing or to make a reply in writing to the Registrar. In case of a conditional acceptance, if the applicant does not object to the conditions, amendments, disclaimer, modifications or limitations requested by the Registrar, the applicant is also required to notify the Registrar in writing, and alter the application accordingly, within the same sixty (60) days period. In both cases, in the absence of a response within the sixty (60) days period, the applicant is deemed to have withdrawn its application. Overall, the registration of a trademark must be completed within six (6) months from the date of application or the Registrar may treat the application as abandoned.

Dealing with Oppositions:

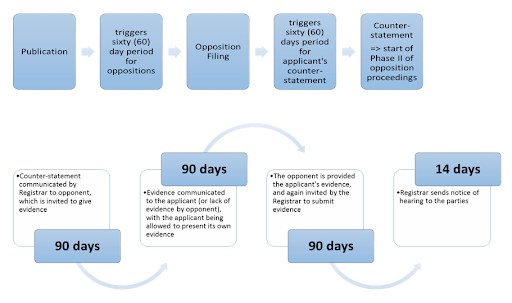

Opposition Period: Once the application is accepted (or, if conditionally accepted, once the application is amended accordingly), the mark will be published in the Intellectual Property Edition of the Cayman Islands Gazette, under the heading “Applications for Registrations”, which triggers a sixty (60) day period for oppositions to be filed.

Opposition Procedure: The Registrar is required to send a notice of any opposition to the applicant, who is then allowed sixty (60 days) to send a counter-statement setting out the grounds supporting its trademark application. A lack of response at this stage will be deemed as the application being withdrawn in respect of the goods and services in respect of which the opposition was filed12. Upon receipt of the applicant’s counter-statement, the Registrar is required to immediately send a copy of the counter-statement to the opponent, who has ninety (90) days to submit evidence (by way of witness statement and any accompanying exhibits) in support of the opposition. The applicant is communicated such evidence (or notified that the opponent failed to present evidence, as the case may be) and allowed to present its own, with any submission triggering another ninety (90) days period for the opponent to submit evidence15 before the Registrar will set a hearing date. In all cases, the parties may waive their right to be heard and request that the Registrar make a determination from the submissions. The Registrar may also, if a settlement agreement is being negotiated, suspend the proceedings for up to twelve months upon a joint application of the parties supported by a statement explaining the nature of the actions taken towards a settlement, the progress made, if the remaining issues are minor or significant, as well as when the parties expect the negotiations to be completed.

Overall, the opposition proceedings could last more than twelve (12) months from the filing of an opposition until the matter is heard by the Registrar, without taking account of any suspension of proceedings for amicable settlement or any appeals of the Registrar’s decision.

Security Undertakings: If one or both of the parties part of the opposition proceedings are non-resident or do not carry on business in the Cayman Islands, the Registrar may require from the agent(s) to give a written undertaking that such party(parties) will bear the costs of opposition proceedings and/or further security to be given19. Failing to provide such security will lead to the party in default to be deemed as having withdrawn their opposition or counter-statement.

First Impressions:

Both the registration rules and the opposition process as they are set out in the Regulations are actually streamlined “user-friendly” versions of the UK/EU models. Accordingly, IP agents and other interested parties will be looking forward to receiving further guidance from the Cayman Islands Intellectual Property Office (CIIPO) during the second half of 2017.

This is not intended to be a substitute for specific legal advice or a legal opinion.

For specific advice, please contact:

Ramona Tudorancea

Corporate / M&A Specialist

Suite 329 | 10 Market Street | Camana Bay |

Grand Cayman KY1-9006 | Cayman Islands

Cayman Tel: +1 (345) 749 7494 |

E ramona.tudorancea@loebsmith.com

W www.loebsmith.com

New Developments Regarding Dissenters’ Rights under Cayman Merger Law

In our recent publication Cayman Merger Take-Privates from NYSE and NASDAQ in 2016 – Year in Review, we discussed some developing trends and lessons that can be learned from merger take-private acquisitions from U.S. stock exchanges completed1 in 2016 using the Cayman Islands statutory merger regime2 (the “Cayman Merger Law”), including our Top 5 Lessons for the Buyout Group and for the Minority Shareholders. In this first issue of our legal insights series regarding the Cayman Merger Law, we take a closer look at the first decision delivered by the Grand Court of the Cayman Islands regarding one of the 2016 merger take-privates.

Ability of Dissenting Shareholders to Seek Interim Payments

In an interim judgement issued on 26th January 2017 in the matter of Blackwell Partners LLC et al v. Qihoo 360 Technology Co Ltd., in a lengthy well-reasoned decision, Hon. Mr. Justice Charles Quin Q.C. decided that interim payments pursuant to the Grand Court Rules (G.C.R.)4 could be requested by dissenting shareholders and granted by the Court during the judicial proceedings initiated to determine the “fair value” of the dissenters’ shares under Section 238 of the Cayman Merger Law5. This decision brings a new and significant development for minority shareholders in their quest to obtain the “fair value” for their shares in the context of a merger take-private.

Overview of Typical Minority Shareholder Strategies:

Diligent minority shareholders typically learn of a merger take-private offer within days of the first press release by the company (“Target”) which announces the receipt of an offer by the Board of Directors and the formation of a special committee of independent directors (the “Special Committee”) to review the offer and negotiate on behalf of the Target. At this point several strategies become available:

Activism & Raising Concerns: Minority shareholders may look towards activist shareholders or take a more active role themselves, either writing to the Board of Target, or communicating to the other shareholders through public media. Any concerns that the minority shareholders may have about the proposed merger should be raised at this stage, such as the merger not being in the best interest of Target, the consideration being below Target’s intrinsic value taking account of the Target’s market share, market position, specialist technologies, accumulated cash position, holding of trading licences relating to certain specialist areas or assets, etc. Ideally, these concerns should be raised sufficiently early before any determination by the Board of Target as to whether or not to approve the offer and recommend it to Target’s shareholders and the execution of the Merger Agreement. The aim of this approach is to ensure that the Special Committee will properly review the offer and in so doing request:

in-depth information about the valuation of Target and the proposed financing and structuring of the merger, which may lead to an increase of the merger consideration negotiated by the Special Committee for the benefit of all shareholders; and/or

additional protections to benefit minority shareholders, such as “majority of minority” provisions in the Merger Agreement6 in order to secure a better bargaining position for minority shareholders leading to the shareholders’ meeting convened to approve the merger and the terms of the Merger Agreement.

Looking for Alternatives: If Target received an offer from the management group or a group composed of the management and certain private equity sponsors (the “Buyout Group”), activist shareholders may try to look for an alternative buyer, generally inviting third party interest, or associate with other sponsors to initiate a counter-offer. This strategy is based on the assumption that the Special Committee will be bound by its fiduciary duties to take into consideration any additional offers received, which may place upward pressures on the initial merger consideration proposed by the Buyout Group. However, the effectiveness of this strategy is generally limited by two factors:

if the Buyout Group, including management of Target (generally in control of a significant number of votes), in the initial offer, clearly states that they do not intend to sell their shares in any alternative transaction, the interest of any third party buyer is greatly diminished (an alternative offer may be deemed “hostile” by the management of Target, and the third party purchaser may invest significant time and money in the proposal with very limited chances of success); and

the Special Committee will not be able to pursue an alternative offer which lacks substance (i.e. merger terms, financing, legal documentation, etc.) otherwise than as a simple manifestation of interest.

Blocking Completion: Minority shareholders may seek to file for an injunction to stay or stop the progress of the merger on the basis that the directors of Target are acting in breach of their fiduciary duties. This strategy is based on the fact that most merger agreements include, as one of the conditions to the closing of the merger, that no final order by a court or other governmental entity shall be in effect that prohibits the consummation of the merger or that makes the consummation of the merger illegal. As such, if minority shareholders are successful in obtaining an injunction and such injunction has not been reversed and is non-appealable, then the merger cannot become effective. In some cases, however, the aim of this strategy is not to block the merger but to engage in settlement discussions with the Target.

Exercising Dissenters’ Rights: Minority shareholders may choose to dissent to the merger under Section 238 of the Companies Law, knowing that Target is required first to negotiate and, in the absence of an agreement with the dissenting shareholders as to the “fair value” of the shares, to file a petition with the Court for judicial determination of the “fair value” amount to be paid. In some cases, the Merger Agreement may include, as one of the conditions to the closing of the merger, that dissenting shareholders do not own more than a certain percentage (which may be in the range of 1% or 5%) of the shares of Target. When coupled with activism by dissenting shareholders, these clauses may put significant pressure on the Buyout Group and the management of Target.

Significance of the ruling in Blackwell Partners LLC et al v. Qihoo 360 Technology Co Ltd:

It is in the context of minority shareholders deciding whether to exercise their dissenting rights under Section 238 of the Companies Law that the interim judgement issued in Blackwell Partners LLC et al v. Qihoo 360 Technology Co Ltd. becomes most significant.

Qihoo 360 Technology is a leading Internet company in China, that was listed on the New York Stock Exchange (NYSE) and that was taken private using the Cayman Merger Law in 2016 for an aggregate merger offer price in excess of US$9billion. As part of the merger take-private transaction, a fairness opinion on the merger offer price of US$51.33 per share was issued by JP Morgan Asia and the merger was approved the Board of Directors in December 2015 and then by the shareholders in March 2016. However, a number of minority shareholders disagreed with the merger offer price and dissented under Section 238 of the Cayman Merger Law.

Without prejudice to the final determination of “fair value” for their shares, the dissenting shareholders immediately requested payment of an amount of US$16,892,549.01 representing the portion of the merger consideration they were entitled to, based on the US$51.33 merger offer price per share. They also requested security for their claims. They were refused on both counts and, failing agreement, the company had to apply to the Cayman Court to seek a “fair value” determination.

The dissenting shareholders presented as evidence two valuation reports indicating a value per share ranging between approximately US$124.4 and US$290.49 per share (well in excess of the merger offer of US$51.33 per share). While the fair value determination proceedings are still ongoing before the Court, the company agreed to pay into court a security deposit amounting to US$92 million, well in excess of the total value of their shareholdings of approximately US$16,892,549.01. The dissenting shareholders requested an interim payment in respect of their merger consideration because, they argued, whatever the outcome of the fair value determination, they would still be paid a substantial sum in respect of their shares. In an interim judgement issued on 26th January 2017, the Court decided in favour of the dissenting shareholders and ordered an interim payment of US$16,892,549.01, representing the portion of the merger consideration they were offered, based on the US$51.33 merger offer price per share.

New Interim Payment Relief: The judgment in this case has opened the door to petitions for interim payment being filed systematically by dissenting shareholders as part of the Section 238 proceedings, at least in the amount of the merger consideration which is offered generally to the shareholders. This will slightly change the balance of power in the negotiations between the Target and the dissenting shareholders, possibly encouraging settlement earlier in the process or for higher amounts.

Agreement on Security Deposit: The security payment made into court by the Target in this case had been more than five times the amount previously offered to the dissenting shareholders as “fair value”, and likely contributed to the decision of the Court to grant an interim payment to the dissenting shareholders. However, in our view, the absence of an agreement as to a security deposit paid into Court should not prevent the Court from granting interim payments. Further guidance on this matter is expected as dissenting shareholders in other pending cases will likely request interim payments on account of the “fair value” of their shares being at least equal to the offered merger consideration. As a reminder, O. 29, r. 12 of Grand Court Rules (G.C.R.) clearly state that the Court retains full discretion with respect to such interim payments:

“the Court may, if it thinks fit, and without prejudice to any contentions of the parties as to the nature or character of the sum to be paid by the defendant, order the defendant to make an interim payment of such amount as it thinks just, after taking into account any set-off, cross-claim or counterclaim on which the defendant may be entitled to rely.”

Amount of Interim Payments: At this early stage, it seems unlikely that any interim payments ordered as part of Section 238 proceedings will exceed the merger consideration as approved as part of the Merger Agreement. However, Blackwell Partners LLC et al v. Qihoo 360 Technology Co Ltd. does not expressly preclude the possibility of relying on expert evidence in order to determine that the “just” amount for an interim payment should exceed the merger consideration. As stated by Hon. Mr. Justice Charles Quin Q.C. in the interim judgement:

“75. (…) because of the limited nature of the Dissenters’ expert evidence and the absence of expert evidence on behalf of the Petitioner, I do not wish to stray into the jurisdiction of the judge who will be making such a determination.

It is for the Judge hearing the Petition to come to a determination of the fair value of the shares of all Dissenters after hearing expert evidence from both the petitioner and the Dissenters.”

Also, an argument can be made that if the Target itself, during negotiations with dissenting shareholders, offered an amount in excess of the original merger consideration (and if this fact is not disputed by the parties), the Court may take into account this higher figure.

Overall, even if it is quite early to tell, Blackwell Partners LLC et al v. Qihoo 360 Technology Co Ltd. will certainly impact dissenting shareholder strategies in the context of merger take-privates, and possibly contribute to the rising number of Section 238 petitions in the Cayman Islands.

This is not intended to be a substitute for specific legal advice or a legal opinion.

For specific advice, please contact:

Gary Smith

Ramona Tudorancea

E ramona.tudorancea@loebsmith.com

1. The word “complete” is used in this article to designate EGM shareholder approval of the merger and is not referring to the effective date of the merger (which is dependent upon filing) or the effective de-listing of the company.

2. Part XVI (sections 232 to 239A) of the Cayman Islands Companies Law

3. Three other cases are pending (China Ming Yang Wind Power Group Limited, E-House (China) Holdings Limited, and E-Commerce China Dangdang Inc.)

4. Order for interim payment in respect of sums other than damages (O.29, r.12).

5. Under the Cayman Merger Law, shareholders who elect to dissent from the merger have the right to receive payment of the “fair value” of their shares if the merger is consummated, but only if they deliver to the company, before the shareholders’ vote which approves the merger, a written objection (and then comply with all procedures and require-ments of Section 238 of the Cayman Islands Companies Law)

6. A “majority of minority” provision is a condition precedent to the closing of the merger, that the merger be approved by a majority of the shareholders that are unaffiliated with the Buyout Group.

Transactions

1. What have been the largest or most noteworthy public M&A transactions in the past 12 months?

In 2016 public M&A activity in the Cayman Islands continued to be marked by an increasing volume of take-private transactions involving Chinese companies previously listed on NASDAQ or NYSE. In this context, “Chinese companies” mean Cayman Islands-domicilled entities within a corporate structure (for example, as part of a VIE structure) where the ultimate operating entity is based in the People’s Republic of China.

Among the most noteworthy transactions completed in 2016 and involving Chinese companies, were the take-privates of the following companies:

China Ming Yang Wind Power Group (NYSE: MY), a wind turbine manufacturer.

China Nepstar Chain Drugstore (NYSE: NPD), a retail drugstore chain.

E-Commerce China Dangdang (NYSE: DANG), a business-to-consumer e-commerce company.

E-House (China) Holdings (NYSE: EJ), a real estate services company.

iDreamSky Technology (NASDAQ: DSKY), an independent mobile game publishing platform.

Ku6 Media Co (NASDAQ: KUTV), an internet video company focused on user-generated content.

Qihoo 360 Technology Co (NYSE: QIHU), an internet company.

Mecox Lane (NASDAQ: MCOX), a multi-brand and multi-channel retailer specialising in health, beauty and lifestyle products.

Sky-mobi (NASDAQ: MOBI) a mobile application platform and game publisher.

Youku Tudou (NYSE: YOKU), a multi-screen entertainment and media company.

Several other similar transactions are in the process of being completed.

2016 public M&A transactions focused on new technology/innovative companies, often in the internet or internet-related sectors. Over half of the take-privates completed in 2016 related to companies with an estimated market value in excess of US$300 million.

Deal Structures

2. What have been the major trends in the structuring of public M&A transactions?

Methods of structuring public M&A transactions

The Cayman Islands laws principally relevant to the conduct of public M&A are:

The Companies Law (2016 Revision) (Companies Law).

The Limited Liability Companies Law 2016 (LLC Law).

Common law

Equitable principles.

Part XVI of the Companies Law (sections 232 to 239A) establishes a streamlined statutory merger regime (Merger Regime) which facilitates mergers and consolidations between one or more companies provided:

At least one constituent company is incorporated under the Companies Law.

All of the following are applicable:

the directors and shareholders of each company participating in the merger approve the merger;

the shareholder vote is passed by special resolution at an extraordinary general meeting (EGM);

the shareholder voting threshold for approving a merger is at least two-thirds of the votes cast (provided no specific provisions in the company’s articles of association (articles) stipulate a higher threshold, and provided the votes cast meet the requirement for a quorum).

The LLC Law also includes a similar framework for Cayman Islands limited liability companies.

In addition to the Merger Regime, public M&A transactions can also be structured as:

Mergers, amalgamations and reconstructions by way of a scheme of arrangement under sections 86 and 87 of the Companies Law and sections 42 and 43 of the LLC Law.

Takeover offer (tender offer) and minority squeeze-outs under section 88 of the Companies Law and section 44 of the LLC Law

Take-private transactions are typically structured as mergers to be carried out under the Merger Regime, with the acquisition group using a Cayman Islands-exempted company as the acquiring corporate vehicle (see below, Take-private transaction).

The Merger Regime is attractive for both companies and investors, due to the process being relatively straightforward and simpler than either a:

Takeover offer (tender offer) under section 88 of the Companies Law.

Court-approved scheme of arrangement under section 86 and 87 of the Companies Law.

Take-private transaction

The most straightforward structure used for a merger take-private is for a new company Merger Co. to be formed in the Cayman Islands by the investors adhering to the takeover group (often involving the founders/managers of the listed company, its parent and/or several private equity investors acting as sponsors for the purposes of the take-private transaction) (Buyout Group) and to then take on finance and to be ultimately merged with the company that is the target of the take-private (Target)

Take-private offer

After obtaining legal and financial advice, the Buyout Group agrees on the terms of the proposed merger take-private and the consideration to be offered to the shareholders of the Target and makes an offer to the board of the Target (Initial Take-Private Offer). Since most of the take-private transactions are initiated by or with the involvement of the management or certain shareholders represented at board level, the merger process requires a special committee formed of independent directors (Special Committee) to be designated to review the take-private offer and negotiate on behalf of the Target with the Buyout Group. This is to both ensure the board is in compliance with the fiduciary duties it owes the Target and to avoid any accusation of self-dealing.

Negotiations

The Special Committee reviews and negotiates the offer with the help of its own independent legal and financial advice, which may lengthen the process. The typical mission of the Special Committee is to:

Investigate and evaluate the Initial Take-Private Offer.

Discuss and negotiate any terms of the merger agreement.

Explore and pursue any alternatives to the Initial Take-Private Offer as the Special Committee deems appropriate (including maintaining the public listing of Target or finding an alternative buyer).

Negotiate definitive agreements with respect to the take-private or any other transaction.

Report to the board the recommendations and conclusions of the Special Committee with respect to the Initial Take-Private Offer.

Board approval

The directors of each company participating in a merger (Merger Co. and Target) must approve the terms and conditions of the proposed merger (Plan of Merger), including, among other things:

How the shares in each participating company will convert into shares in the surviving company or other property (for example, cash payable to shareholders).

What rights and restrictions will attach to the shares in the surviving company.

How the memorandum and articles of the surviving company will be amended.

What the amounts or benefits paid or payable to any director consequent upon the merger will be.

Shareholder approval

For each constituent company (the Merger Co. and the Target), the Plan of Merger must be authorised by a special resolution of the shareholders who have the right to receive notice of, attend and vote at the general shareholders’ meeting, voting as one class with at least a two-thirds majority.

Consents

Each participating company must also obtain the consent of:

Each creditor holding a fixed or floating security interest.

Any other relevant consents or filings with relevant regulatory authorities (such as the Cayman Islands Monetary Authority or authorities in the overseas jurisdiction where the Target is registered and/or operates).

Filing and registration

After obtaining all necessary authorizations and consents, the Plan of Merger must be signed by a director on behalf of each participating company and filed with the Cayman Islands Registrar of Companies, who will register the Plan of Merger and issue a certificate of merger.

Effective date

The merger will be effective on the date the Plan of Merger is registered by the Registrar of Companies (unless the Plan of Merger provides for a later specified date or event). On the effective date:

All right and assets of each of the participating companies will immediately vest in the surviving company.

Subject to any specific arrangements, the surviving company will inherit all assets and liabilities of each of the participating companies (Merger Co. and Target).

Subject to the constitutional documents of each company, there are no restrictions under the Cayman Islands law on the type of consideration offered as part of a merger (which can be cash, securities, other property or a combination of assets). Different treatment between different classes of shares or among different shareholders within the same class is possible.

Merger take-privates are generally characterised by a cash consideration being offered to shareholders other than persons affiliated with the Buyout Group. Any dissenting shareholders are granted special appraisal rights under the Companies Law, ensuring they obtain “fair value” for their shares under section 238 of the Companies Law.

Private equity

3. What has been the level/extent of private equity-backed bids in the past 12 months?

About half of the 2016 merger take-privates included private-equity firms among the sponsors in the original non-binding proposals. In one case, a private equity firm launched a competing bid at a higher price and managed to convince several other investors to join in.

Finance

4. How were the largest or most noteworthy public M&A transactions financed?

In about 50% of the reported merger take-privates of Chinese companies, completed in 2016 using the Merger Regime, the founders/managers of the listed company, its parent and/or several private equity investors acting as sponsors for the purposes of the take-private transaction (Buyout Group) paid for the merger consideration with either:

Available cash of the Target.

Equity financing provided by the Buyout Group.

For smaller deals (less than US$50 million), which were mostly 100% equity-financed or financed using available cash of the Target or its parent, the merger process from the Initial Take-Private Offer and up to the extraordinary general meeting (EGM) approval typically lasted between six and nine months. However, larger deals (more than US$300 million), which were financed by a combination of cash, equity and debt financing, required about 11 to 20 months to complete.

Regulatory clearances and other authorisations

5. Please briefly outline the approach of the competition regulator(s) in the past 12 months. Were any public M&A transactions blocked by a regulator, or cleared subject to specific remedies, conditions or restrictions?

There is no anti-trust legislation in the Cayman Islands. However, there are change-of-control rules for companies operating in regulated sectors (such as those regulated by the Cayman Islands Monetary Authority under the Banks and Trust Companies Law (2013 Revision), the Insurance Law 2010 (as amended) or the Mutual Funds Law (2105 Revision)).

In addition, ownership and control restrictions apply to entities regulated by the Information & Communications Technology Authority Law (2016 Revision).

Blocked transactions?

Not applicable.

Cleared subject to remedies, conditions or restrictions?

Not applicable.

Future developments

6. What will be the main factors affecting the public M&A market over the next 12 months, and how do you expect the market to develop?

In 2015 the Cayman Islands Grand Court (Grand Court) for the first time issued guidance on the determination of “fair value” in the context of a claim by dissenting shareholders under the Cayman Merger Law in Re: Integra Group [FSD 92 of 2014].