About Loeb Smith

People

Sectors

Expertise

- Legal Service

- Banking and Finance

- Blockchain, Fintech and Cryptocurrency

- Capital Markets and Privatization

- Corporate

- Cybersecurity and Data Privacy

- Insolvency, Restructuring and Corporate Recovery

- Insurance and Reinsurance

- Intellectual Property

- Investment Funds

- Litigation and Dispute Resolution

- Mergers and Acquisitions

- Private Client and Family Office

- Private Equity and Venture Capital

- Governance, Regulatory and Compliance

- Entity Formation and Managed Services

- Consulting

- Legal Service

News and Announcements

Locations

Subscribe Newsletters

Contact

The Cayman Islands have taken significant steps in recent years to update and modernize the legal framework with respect to protection of intellectual property (IP). Traditionally, the Cayman Islands patents and trademarks registry only served to extend rights which had previously been registered in the U.K. or the European Union. However, in addition to an overhaul of the copyright laws earlier this year1, lawmakers are currently in the process of modernizing the patents and trademarks laws2 to encourage growth of the IP-intensive industries.

While the patent rules will only be slightly amended to be more protective of innovators3, the most significant reform is the creation of a new stand-alone trademark system for the Cayman Islands which would not require a first registration in the U.K. or at the European Union level4. Finally, companies will also be able to extend protection of their industrial design rights in the Cayman Islands.

The Cayman Islands aim to become an important offshore hub for the development and commercial exploitation of IP

IP encompasses inventions, literary and artistic works, symbols, names and images used in commerce, and is currently the most important assets of many technology and industrial companies. The ability to protect and maximize the value of IP assets is therefore of strategic importance and often is one of the main factors which contribute to a company’s growth.

According to the most recent statistics from the WIPO IP Statistics Data Center, global patent applications in 2015 rose to 2.9 million, with more than 1 million inventions coming from China, while trademark applications reached about 6 million, almost half of them filed by Chinese companies. In a report from the U.S. Department of Commerce published in September 2016, more than 25% of the existing industries in the United States were defined as “IP-intensive”, and in 2014 they already accounted for more than a third of the total GDP of the United States.

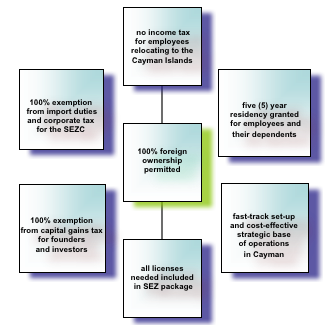

Largely known as one of the premier offshore financial centres for hedge funds and other investment vehicles, Cayman is now trying to become a popular destination for IP migration but also development5. Businesses in areas related to innovation and technology can now be established in Cayman under the special rules of the Special Economic Zone (SEZ). The SEZ now includes more than 180 tech and knowledge-based companies and is rapidly growing due to entrepreneurs realizing that Cayman is a very attractive place to house IP-intensive businesses.

In the first of our series of legal insights on owning IP through a Cayman Islands structure, we will explore some of the key benefits of incorporating an exempted company as part of the SEZ.

Key Benefits of being in the Cayman Islands Special Economic Zone (SEZ)

For many of the IP-intensive industries, intangibles are the only fixed assets on a company’s balance sheet. Technology and media businesses develop their customer base all over the world. Such companies often start small, with a team of talented and dedicated people, and in their growing stage may be attracted to relocating in the Cayman Islands6 to benefit from its stable yet business-friendly legal framework.

The Cayman Islands exempted company is the preferred corporate structure for such businesses (no regulatory approvals, no need for resident directors, no requirement for an annual audit, and no need for an annual shareholders’ meeting).

In addition, the existing or newly incorporated exempted company may apply to be registered as a Special Economic Zone Company (SEZC), allowing it to benefit from specific advantages such as speeding up very significantly work permit applications for the employees to be relocated to the Cayman Islands or access to very good infrastructure and support services. The SEZ, offering a lean, flexible and tax-friendly regulatory environment in an all-inclusive package, often gives talented inventors and entrepreneurs the best solutions for growth.

Businesses in the following sectors may qualify to set up as an SEZC:

- Commodities & Derivatives

- Media & Marketing

- Internet & Technology

- Biotechnology

- Education & Training

Additional advantages of incorporating a Cayman exempted company

1. No Prohibition on Financial Assistance

There is no prohibition in the Cayman Islands for an exempted company to provide financial assistance with regard to the acquisition of its own shares. This provides the founders of a company with significantly more flexibility to structure a deal to buy out a previous shareholder for example without the need to find a third party investor or to become extremely indebted. (The directors of the company owe however a fiduciary duty to the company to act in good faith in the best interests of the company in agreeing to provide the financial assistance.)

2. No Taxes on Income, Disposal of IP Assets or Capital Gains

Remunerations paid to the employees and distributions to shareholders are not subjected to any tax in the Cayman Islands. There are also no taxes for the corporate income or any registration taxes or stamp duty to be paid on the transfer of shares (other than in relation to the transfer of shares in a company which holds real estate in the Cayman Islands).

3. More Flexibility for Distributions

Under the Cayman Islands Companies Law, the company has a greater latitude in distributing profits as dividends. For example, a sale of a portion of the IP assets could result in a dividend distribution, but also a simple revaluation of the IP assets on the balance sheet (provided that the valuation is not speculative). Also, the company is permitted to use its share premium account to fund the payment of dividends (provided that the company remains solvent thereafter).

4. IP Protected by Commercial Confidentiality

The accounts and financial statements of the Cayman Islands exempted company are not filed or published and the corporate documents are not available to inspection by the public, therefore providing a high degree of commercial confidentiality, which is often critical for IP asset protection. Before the company reaches critical mass and is ready to go public, no competitor will be able to glean any information from management reports or financial statements.

View Full PDF

This Guidance Note is not intended to be a substitute for specific legal advice or a legal opinion. It deals in broad terms only and is intended to merely provide a brief overview and general guidance only. For more specific advice please refer to your usual Loeb Smith contact or:

E ramona.tudorancea@loebsmith.com

E elizabeth.kenny@loebsmith.com

© Loeb Smith Attorneys, 2018

1. The Copyright (Cayman Islands) Order 2015 and the Copyright (Cayman Islands) (Amendment) Order, 2016 (collectively, the Copyright Orders) extend most of the current U.K. copyright law to the Cayman Islands.

2. Currently in the process of being adopted are The Patents and Trade Marks (Amendment) Bill, 2016 and The Trade Marks Bill, 2016.

3. The proposed reform aims to encourage innovation by dissuading “patent trolls” – the new law will specifically prohibit or at least discourage “assertions of patent infringement which are made in bad faith”.

4. To apply the new IP rules, the Cayman Islands have also established the Cayman Islands Intellectual Property Office (CIIPO) as a separate section of the Cayman Islands Government’s General Registry Department, as well as a separate Intellectual Property Law Gazette.

5. Over the last 30 years, larger multinational companies (especially Fortune 1000 companies) have been migrating IP to lower-tax jurisdictions benefiting from double taxation treaties (such as Ireland, Switzerland, Netherlands, Singapore, etc.) as part of their tax optimization strategy. The IP would be developed in high-tax jurisdictions allowing the taxpayer to incur deductible losses and expenses, and then transferred abroad when it became an income-producing asset. This practice has been, however, increasingly challenged by tax authorities all over the world.

6. The Cayman Islands Companies Law allows for the registration (called transfer by continuation) of a company with limited liability and share capital incorporated in a foreign jurisdiction (provided that the laws of such foreign jurisdiction do not prohibit the relocation).

Introduction

Cayman Islands holding companies, operating companies, and investment funds structured as companies pay dividends and make other distributions to shareholders and investors all the time, but what are the Cayman Islands’ rules governing the payment of dividends and making of distributions? In the first of our series of legal insights on the payment of dividends and other distributions1 by Cayman companies, we explore the concept of “profits” and how “profits” are calculated under Cayman Islands law.

Legal position as it relates to payment of dividends and making distributions generally

Under Cayman Islands law, even though the shareholders are the owners of a Cayman company the property of that company belongs to the company and not to its shareholders. For this reason a company cannot simply pay or distribute its property to its shareholders. There are legal requirements to be followed in order to ensure, among other things, that the Directors of the company do not, for example, find themselves personally liable for authorising an unlawful dividend or distribution2.

The legal position is that dividends and other distributions of a Cayman company may be paid out of profits or from the company’s share premium account. However, where dividends or other distributions are to be paid from the company’s share premium account, there is a solvency test which must be passed (i.e. immediately following the date on which the distribution or dividend is proposed to be paid, the company must be able to pay its debts as they fall due in the ordinary course of business)3.

Distributions of capital are also permitted by means of the redemption of redeemable shares or the company purchasing its own shares. Under section 37(3)(f) of the Companies Law4, shares may be redeemed or purchased (A) out of profits of the company, (B) out of the share premium account, or (C) out of the proceeds of a fresh issue of shares made for the purposes of the redemption or purchase, or (D) out of capital if (i) it is authorised by the company’s articles of association and (ii) provided that it passes the solvency test (i.e. immediately following the date on which the payment out of capital is proposed to be made the company must be able to pay its debts as they fall due in the ordinary course of business).

Payment out of “profits”

Cayman Islands law as it relates to the payment of dividends out of profits is largely judge-made law. There is no statutory definition of “profits” in the Companies Law and no authority of the Cayman Islands courts which may be looked to for guidance as the meaning of “profits”.

In determining what constitutes “profits” of a Cayman company for the purposes of paying dividends and making other distributions to shareholders and investors5 it is necessary to look at the rules laid down by English case-law authorities based on the English Companies Act 1948 and also earlier English Companies law statutes which are of persuasive authority in the Cayman Islands. Subsequent statutes in England (e.g. the Companies Act 1985 which has been superseded by the Companies Act 2006) and the case-law authority based on such subsequent enactments would not necessarily be regarded as persuasive authority in the Cayman Islands since the Cayman Islands Companies Law is based, in the material part, upon the Companies Act 1948 (and its predecessors) and has not been amended subsequently in a manner analogous to the legislative amendments introduced in England.

How to calculate “Profits”?

In practice, “profits” is normally taken to mean the accumulated retained earnings or profit of previous years which have not been capitalised by a bonus issue or transferred to the capital redemption reserve, shown on the company’s balance sheet, plus all net trading profits shown in the profit and loss account for the current financial year6.

In light of the rulings in the English case-law authorities based on the English Companies Act 1948 and also earlier English Companies law statutes, it would appear that the following rules can be applied as a guide with regard to how the Cayman Islands’ courts would determine the question of how profits in a Cayman company are to be calculated for the purposes of making lawful dividend payments and other distributions:

1.1 A loss made on fixed assets does not have to be recovered before treating a revenue or income profit as available for distribution to shareholders and it is not legally essential to make any provision for depreciation. Sums written off out of past profits as depreciation of fixed capital may be applied as profit available for distribution if on a revaluation of the fixed assets no depreciation has in fact taken place.

1.2 Losses of circulating assets (i.e. trading stock) in the current accounting period must be made good however for otherwise there is no profit.

1.3 A realised capital profit on the sale of fixed assets may be treated as a profit available for distribution at any rate if there is an overall surplus of fixed and circulating assets over liabilities. However best practice is probably to revalue all fixed assets before making this assessment.

1.4 An unrealised capital profit on a revaluation of assets may also be used to fund a distribution to shareholders. However caution must be exercised by the Directors in this situation because an unrealised capital profit may well involve speculative matters of valuation and in the event that a lesser amount is achieved on actual sale a question may always arise as to whether or not the Directors acted properly in arriving at the valuation.

1.5 Losses, even revenue losses on circulating assets (i.e. trading stock/assets being used up in the business) made in a previous accounting period need not be recovered, if there were no profits carried forward into that period to make them good, since such losses are then categorised as losses of capital.

1.6 A distribution to shareholders can be made provided there is a profit on the current financial year of the company regardless of capital losses of a prior financial year. In other words, for the purposes of this rule each accounting period is treated in isolation .

1.7 However, in contrast to the above-mentioned rule, past profits (retained earnings) from a previous financial period may be carried forward and used to fund a distribution in the current financial year.

This Guidance Note is not intended to be a substitute for specific legal advice or a legal opinion. It deals in broad terms only and is intended to merely provide a brief overview and general guidance only. For more specific advice please refer to your usual Loeb Smith contact or:

E ramona.tudorancea@loebsmith.com

Introduction

With effect from 19 October 2017, it is possible to incorporate Foundation Companies in the Cayman Islands. The Foundation Companies Law, 2017 (the “Law“) allows for the formation and/or registration of a new Cayman Islands corporate vehicle: the Foundation Company. A Foundation Company will be governed by the Companies Law, 2016 except to the extent excluded or modified by Schedule 1 to the Law, or otherwise inconsistent with the provisions of the Law.

It is anticipated that the new Foundation Company structure will, among other things, (1) create a number of uses for private clients to hold family wealth and businesses other than through trusts, and (2) greatly enhance the flexibility for structuring finance transactions.

Key Features of Foundation Companies

• Conversion or Formation – An existing company will be able to apply to the Companies Registry to convert into a Foundation Company or a new company will be able to apply to be formed as a Foundation Company.

• Separate legal personality – A Foundation Company is a body corporate with legal personality separate and distinct from that of its members, directors, officers, supervisors and founder. It has capacity to sue and be sued in its own name and to hold property. There are no restrictions on the type of property or asset a Foundation Company may hold.

• Capital Structure – A Foundation Company must be limited by shares or by guarantee, with or without share capital.

• Constitution – A Foundation Company is required to have a set of Articles of Association (“Articles“) and a Memorandum of Association (“Memorandum“). The Memorandum must (i) state that the company is a foundation company, (ii) generally or specifically describe its objects (which may, but need not, be beneficial to other persons), (iii) provide directly or by reference to its Articles, for the disposal of any surplus assets the Foundation Company may have on winding-up; and (iv) prohibit dividends or other distributions of profits or assets to its members or proposed members in their capacity as members.

• Objects/Purpose – A Foundation Company may be established for any lawful purpose, (i.e. commercial, charitable or philanthropic or any private purposes or a combination of such purposes.

• Capital Requirements – There is no minimum capital requirement for a Foundation Company and a founder or any other person may add assets to the Foundation Company subject to acceptance by the Foundation Company.

• Secretary – A Foundation Company is required to have a “qualified person” at all times as its secretary. A qualified person for the purposes of a Foundation Company means a person who is licensed or permitted by the Companies Management Law (2003 Revision) to provide company management services in the Cayman Islands to the Foundation Company. The secretary is required to maintain a full and proper record of its activities and enquiries made for giving notices.

• Director – A Foundation Company is managed by a board of directors. Any individual of full capacity and/or any company may be a director. The duties that the directors of a Foundation Company owe to the Foundation Company are the same duties as directors of any other company owe to that other company. The standard of care, diligence and skill applicable to directors of a Foundation Company is same as that owed by directors to any other company. The directors of a Foundation Company need not be resident in the Cayman Islands.

• Tax Status – A Foundation Company will be exempt from any Cayman Islands income tax or capital gains tax and is able to obtain a tax undertaking certificate from the Cayman Islands government guaranteeing no change to their tax status for a period of up to 50 years from the date of the undertaking.

• Dispute Resolution – A Foundation Company’s constitution may provide for the resolution of disputes, differences or difficulties with or among its directors, officers, interested persons or beneficiaries (to the extent beneficiaries have any rights) concerning the Foundation Company or its operations or affairs, or the duties, powers or rights of persons under the constitution by arbitration or by any other lawful method.

• Membership – A Foundation Company’s constitution may grant or authorise the grant to any person or description of persons, whether or not ascertained or in existence, the right to become a member of the Foundation Company and such right is enforceable by action against the Foundation Company. Additionally, a Foundation Company may cease to have members if its Memorandum so permits or requires and it continues to have one or more supervisors. Ceasing to have members will not affect the Foundation Company’s existence, capacity or powers. If a Foundation Company has ceased to have members, it may not subsequently admit members, or issue shares, unless expressly authorised to do so by its constitution. The liability of members of a Foundation Company is limited.

• Supervisor – A Foundation Company’s constitution may grant, or authorise the grant, to any person or persons or description of persons, whether or not ascertained or in existence, the right to become a Supervisor of the Foundation Company and such right is enforceable by action against the Foundation Company, whether or not enforceable as a matter of contract. Supervisors are persons, other than members, who, under the Foundation Company’s constitution, have a right to attend and vote at general meetings, whether or not the person has supervisory powers or duties.

• Register of Supervisors – In addition to the register of directors, register of members, and register of mortgages and charges that Cayman Islands companies are required to keep, a Foundation Company must keep at its registered office an up to date register of supervisors (which contains the names and addresses of its supervisors, the date on which each of its supervisors was appointed, and any date on which a supervisor’s appointment ceased). Failure to do so is subject to criminal sanction on the Foundation Company and every director or manager of the Foundation Company who knowingly and wilfully authorised or permitted the contravention.

Key Benefits of Foundation Companies

It is anticipated that Foundation Companies will have a wide range of uses, e.g.

-

- as special purpose vehicles (SPVs) in finance transactions;

- for ICOs, and other crypto-currency offerings;

- as charities;

- re-organisation of assets within family offices;

- as protectors or enforcers (in relation to other trusts or fiduciary structures);

- as mechanisms within private trust company structures.

If desired, individuals in control of a Foundation Company can mirror the board(s) of existing family enterprises by appointing the same persons as Directors of the Foundation Company.

The ability for beneficiaries of a Foundation Company to have different entitlements as beneficiaries will also be very useful for asset protection purposes. Additionally, the Foundation Company will be ideal for holding higher-risk, less diversified assets, since “interested persons” will owe their duty to the Foundation Company, and not to any potential beneficiaries.

For specific advice on Cayman Islands Foundation Companies, please contact:

Gary Smith

Guidance for Directors registered with the Cayman Islands Monetary Authority

Renewal of Director registration

Directors who are registered with CIMA in accordance with The Directors Registration and Licensing Law, 2014 (“DRLL”) in connection with being a Director of an entity that is registered with CIMA (e.g. registered Mutual Fund or an investment management or investment advisory entity that has “Excluded Person” status under the Securities Investment Business Law (2015 Revision)) (a “Covered Entity”) should by this time of the year have received a reminder from CIMA to renew registration via the CIMA portal https://gateway.cimaconnect.com/. A Director should renew his or her registration with CIMA if he or she will continue to be a Director of one or more Covered Entity that either (1) will carry on business for some or all of 2017, or (2) is in the process of winding down such business but the process will not cease prior to 31 December 2016.

Resignation from a Covered Entity

CIMA has stated[i] that if a Director no longer wishes to be registered or licensed as a Director of a Covered Entity, the Director must liaise with the Covered Entity’s registered office and ensure that CIMA receives written resolutions or an updated register of directors, stamped by the Registrar of Companies, to duly notify CIMA of the Director’s resignation from that Covered Entity.

Resignation of a Director from a Covered Entity will not automatically result in a surrender of the Director’s registration or licence under the DRLL.

Surrender of Director registration

CIMA has also stated[ii] that if a Director no longer wishes to be registered or licensed as a Director in accordance with the DRLL, he or she must first resign as a Director of all Covered Entities, then log into the CIMA portal, complete the requisite information under “Surrender”, and pay the relevant surrender fee (US$731.71).

Once the Director has paid the surrender fee, CIMA will check its records to confirm that the Director is no longer listed as a Director on any Covered Entity. If he or she remains as a Director on a Covered Entity, CIMA has stated that it will be unable to process the Director’s surrender application.

In addition to submitting the surrender fee, the Director is required to submit a formal letter which MUST contain the following information:

1. that he or she has resigned as a Director of all Covered Entities;

2. that he or she no longer plans to act as a Director on any Covered Entity; and

3. that if he or she would like to act on any other Covered Entity or wishes to resume directorship services after he or she has surrendered his or her registration or licence, he or she will re-apply under the DRLL.

The Director is responsible for updating his or her records accordingly and must complete the requirements to surrender his or her registration or licence before the 31st December in order to avoid accruing next year’s annual fees, as well as penalties calculated at 1/12th of the annual fee for every month or part of a month after the 15th of January in each year that the fee is not paid.

As stated above, Directors who will continue to provide directorship services and wish to remain current with their registration or licence status under the DRLL MUST, on or before the 15th of January in each calendar year, renew their registration or licence through the CIMA portal.

For specific advice on renewal or surrender under the DRLL or resignation from a Covered Entity, please contact any of:

E gary.smith@loebsmith.com

E yun.sheng@loebsmith.com

[i] CIMA’s Supervisory Issues & Information Circular– Second Edition issued in October 2016

[ii] CIMA’s Supervisory Issues & Information Circular– Second Edition issued in October 2016

On October 25, Loeb Smith Attorneys’ Cayman Islands-based corporate lawyer Ramona Tudorancea will chair and moderate the panel titled “Caribbean Offshore Jurisdictions as Stepping Stones for Cross-Border Investments in the Americas“, scheduled as part of the Miami Fall Meeting of the Section of International Law of the American Bar Association and taking place at the JW Marriot Marquis, Met Ballroom 4, starting 4.30 PM.

Panelists include James H. Barrett from Baker & McKenzie LLP (Miami), Fernanda Bastos from Buhatem, Souza, Cescon, Barrieu & Flesch Advogados (Brazil), Pablo Falabella from Bulló Abogados (Argentina), Fabian A. Pal (Miami), and Kevin P. Scanlan from Kramer Levin Naftalis & Frankel LLP (New York).

The panel is sponsored by the Lawyers Abroad Committee (LAC), where Ms. Tudorancea currently serves as a Vice-Chair of Publications, and co-sponsored by the International M&A and Joint Venture Committee, the Latin America and Caribbean Committee, and the International Tax Committee.

Introduction

The Cayman Islands have been the leading offshore jurisdiction for merger and acquisition (M&A) activity over the last few years, with a steady flow of over USD77bn in combined value of target companies for 2016 and 2017, and a peak of over USD115bn in 2015. By way of comparison, for 2017, the combined value of transactions targeting companies incorporated in the British Virgin Islands (BVI) and Hong Kong was USD37bn and USD40bn respectively1.

A significant portion of this M&A activity was related to merger take-privates involving Cayman-incorporated companies listed on U.S. stock exchanges, which were achieved through the Cayman Islands statutory merger regime (the “Cayman Merger Law”). The related transactions also generated a significant number of litigated cases in the Cayman Islands, as any shareholder who is unhappy with the consideration offered as part of a merger may dissent and is entitled to payment of fair value of its shares under Section 238 of the Cayman Islands Companies Law (2018 Revision) (the “Companies Law”), and such fair value, if not agreed between the parties, is determined by the Grand Court of the Cayman Islands (the “Court”).

2017 Cases Favourable to Dissenting Shareholders

In 2017, several decisions issued by the Court improved upon and clarified the rights of minority shareholders dissenting from a merger, both in respect to procedural matters2, and by allowing the dissenting shareholders to benefit from interim payment relief3. However, the most significant development of the year 2017 had been the judgment issued on 25th April 2017 in the matter of Shanda Games Limited, when the Court reaffirmed its seminal decision in the matter of Integra Group on 28th August 2015, and decided that “fair value” was to be determined on the basis of the Company as a going concern immediately prior to the merger, without any minority discount.

The Court had based its decision on fair value valuation principles in Delaware and Canada because it was the Delaware and Canadian merger law regimes that had inspired the adoption of the Cayman Merger Law. The judgment in the matter of Shanda Games Limited also addressed many technical issues of valuation methodology (including the use of the discounted cashflow (“DCF”) model, how depreciation should factor into the valuation, taking account of trading at any point up until the valuation date, taking account of the actual or anticipated performance against the market, etc.).

Court of Appeal Judgment Regarding Shanda Games Limited

However, following an appeal brought by Shanda Games, the Cayman Islands Court of Appeal held on 6th March 2018 that, contrary to what had been previously decided by the Court, a “minority discount” should be applied in assessing the “fair value” of a dissenter’s shares. In so doing, the Court of Appeal decided to follow Shanda Games’ arguments that the trial judge should have taken into account English case law authorities before looking further to what the Delaware courts had determined.

The English case law authorities cited by the Court of Appeal discussed fairness (or rather unfairness) in the context of disputes with regard to schemes of arrangement and squeeze-outs mechanisms4. In Re Hoare & Co. Ltd (1933) 150 LT 374, cited by the Court of Appeal in paragraph 35 of its decision, the paragraphs cited make it clear that the reasoning for the English court’s conclusion that a minority discount did not make the scheme of arrangement unfair was that the scheme had gathered the approval of the required 90% of the shareholders affected by the offer. This fact, the English court reasoned, constituted prima facie evidence as to fairness and dissentients did not produce appropriate evidence to disprove it. In Re Linton Park plc [2005] EWHC 3545 (Ch); [2008] 17, the English court similarly states that “whether the package on offer is a fair price for the shares is a matter which the shareholders are far better to able to judge than the court, and for that reason the court will be very slow to depart from the majority view”. In Re Grierson, Oldham & Adams Ltd [1968] Ch 17, that the English court issues a substantial view on minority discounts by stating that “it is not unfair to offer a minority shareholder the value of what he possesses, i.e. a minority shareholding”.

Analysis

Admittedly, the adoption of a minority discount in the assessment of “fair value” is by itself a serious setback to dissenting shareholders utilising the Cayman Merger Law to obtain fair value for their shares. However, the consequences of the Court of Appeal’s decision in the matter of Shanda Games Limited may be more far-reaching.

It has been so far generally accepted under Cayman Islands law that under a scheme of arrangement or a statutory squeezeout under section 88 of the Companies Law dissenting shareholders would be “dragged along” if the scheme is approved or the conditions of the statutory squeeze-out are met without a requirement that the Court re-examines the “fair value” of the consideration offered to them. Also, it appears to have been generally accepted that the Court would not in fact intervene unless there is a clear case of unfair or prejudicial treatment of shareholders in these circumstances. It is this exact approach that is illustrated by the English case law authorities cited by the Court of Appeal and referred to above. This minimal level of intervention by the English courts with respect to valuation issues is well justified, as neither schemes of arrangement5 nor squeeze-outs6 are susceptible to the same measure of control (or abuse) by the buyout group in a merger take-private transaction as it is possible under the Cayman Merger Law:

i. a scheme of arrangement not only requires approval by 75% of shareholders in each class and 75% in value of creditors present and voting (a higher majority than required under the Cayman Merger Law), buta. founders or insiders may be treated by the Court as a separate class, which basically translates into a “majority of minority” requirement; and

b. dissenting shareholder are entitled to actually appear before the Court and argue against the scheme; and

ii. a statutory squeeze-out requires that at least 90% in value of shares affected by the offer (i.e. the shares not held by the buyout group) agree to the offer.

The above requirements, if met, translate into strong evidence of fairness with respect to consideration offered given the high thresholds for approval. Accordingly, it could be reasonably argued that there is less need for the Court, and no opportunity under Sections 86 and 88 of the Companies Law, to examine valuation issues.

Not so under Section 238 of the Companies Law, where the approval threshold, two-thirds majority of votes cast, is significantly lower and may be easily controlled by the buyout group itself.

The fact that the Court of Appeal chose to treat mergers, schemes of arrangement and squeeze-outs in a very similar manner with regard to valuation methodology could now open the door (even though this was not necessarily intended) to a dangerous blurring of categories which could lead to further shrinkage of the “fair value” standard under Section 238 of the Companies Law. For now, however, the existing legal principles governing determination of “fair value” for the dissenters’ shares remain unchanged subject to the exception of a minority discount being applied in recognition of the reality that dissenters hold a minority interest. The Honourable John Martin QC, in handing down the judgment of the Cayman Islands Court of Appeal stated:

“The position in the Cayman Islands is accordingly that there are now three mechanisms contained in the Companies Law by which the shares of dissentients may be acquired: by squeeze-out with a 90% majority, by scheme of arrangement with a 75% majority, and under section 238 with a two-thirds majority. Assuming, as I do, that the English approach to squeeze-outs and scheme of arrangement acquisitions would be applied in the Cayman Islands, those two mechanisms allow a minority discount to be applied to the cost of acquisition of dissentients’ shares. It seems to me unlikely in the extreme that the simplified merger and consolidation regime introduced as Part XVI of the Companies Law was intended to depart from that approach; it is to be presumed that the three mechanisms, contained in the same piece of legislation and capable of serving the same purpose in different ways, are to be construed from the same standpoint. Nothing in the wording of section 238 suggests that a different approach was intended; indeed, as Shanda pointed out, there is nothing in the wording of the section that suggests that the focus is to be on the value of the company rather than on the value of the shares. (…) For these reasons, it appears to me that section 238 requires fair value to be attributed to what the dissentient shareholder possesses. If what he possesses is a minority shareholding, it is to be valued as such, if he holds shares to which particular rights or liabilities attach, the shares are to be valued as subject to those rights or liabilities.” (Paragraphs 49-50 of the Court of Appeals decision in the matter of Shanda Games Limited).

This publication is not intended to be a substitute for specific legal advice or a legal opinion. For specific advice, please contact your usual Loeb Smith attorney or either:

E gary.smith@loebsmith.com

E ramona.tudorancea@loebsmith.com

1 Based on figures included in the Global M&A Review 2017 report published by Bureau van Dijk – A Moody’s Analytics Company.

2 In a decision Homeinns Hotel Group v Maso Capital Investments Limited and others dated 7th February 2017, the Court examined the extent of discovery by the parties which is necessary for valuation purposes and supported the dissenters’ position that the Court could order certain classes of documents to be provided by the Company. In the matter of Qihoo 360 Technology Co Ltd., on 24th July 2017, the Court confirmed that it does have the power to order the appointment of an independent expert in forensic information technology to conduct an audit to verify the Company’s compliance with its discovery obligations.

3 In an interim judgement issued on 26th January 2017 in the matter of Blackwell Partners LLC et al v. Qihoo 360 Technology Co Ltd., the Court decided that interim payments pursuant to the Grand Court Rules (G.C.R.) could be requested by dissenting shareholders and granted by the Court during the judicial proceedings initiated to determine the “fair value” of the dissenters’ shares under Section 238 of the Cayman Merger Law. A decision issued on 8th August 2017 in the matter of Qunar Cayman Islands Ltd. provided further guidance on interim relief when the Court reaffirmed that requests for interim payment can be made by dissenting shareholders as part of the Section 238 proceedings, and that the Court has jurisdiction to grant such payments, in an amount determined to be “just”. Finally, in the matter of Trina Solar Limited, in written judgments dated 18th July 2017 and 25th August 2017, the Court held that a consent order for an interim payment entered into between the Company and the minority shareholders dissenting from the merger was binding upon the Company when made.

4 The Court of Appeals specifically acknowledges this in paragraph 45 of the decision: “although the English cases do not concern an appraisal mechanism, or deal with a statutory standard of fair value, they are concerned with fair value of the shares”.

5 Section 86 of the Cayman Islands Companies Law

6 Section 88 of the Cayman Islands Companies Law

Introduction

In our previous publication Interim Payment Relief: New Developments Regarding Dissenters’ Rights under Cayman Merger Law, we discussed a new and significant development for minority shareholders in their quest to obtain the “fair value” for their shares in the context of a merger take-private carried out under the Cayman Islands statutory merger regime (the “Cayman Merger Law”).

In an interim judgement issued on 26th January 2017 in the matter of Blackwell Partners LLC et al v. Qihoo 360 Technology Co Ltd., the Court decided that interim payments pursuant to the Grand Court Rules (G.C.R.) could be requested by dissenting shareholders and granted by the Court during the judicial proceedings initiated under Section 238 of the Cayman Merger Law. Dissenters’ rights to interim payments now seem entrenched after a second decision was issued on 8th August 2017 in the matter of Qunar Cayman Islands Ltd.

Building Blocks of the Dissenters’ Rights to Interim Relief:

Building upon the reasoning previously adopted by the Court in Qihoo 360 Technology Co Ltd., the recent ruling in Qunar Cayman Islands Ltd. provides further guidance on interim relief available as part of proceedings initiated under Section 238 of the Cayman Merger Law.

1. Availability of Interim Relief Confirmed: As expected, the recent judgment followed Qihoo 360 Technology Co Ltd. and confirmed that requests for interim payment can be made by dissenting shareholders as part of the Section 238 proceedings, and that the Court has jurisdiction to grant such payments, in an amount determined to be “just”. In the matter of Qunar Cayman Islands Ltd., the “just” payment was deemed to be equal to the amount of the merger consideration which had been offered generally to the shareholders by the company.

2. Evidence Needed for Interim Relief to be Granted: At this stage, it seems unlikely that any interim payments ordered as part of Section 238 proceedings will exceed the merger consideration as approved as part of the merger agreement, especially if, as was the case in Qunar Cayman Islands Ltd., the request for interim relief is made before any expert report is submitted on valuation issues. For the purposes of interim relief, however, the Court appears willing and able to rely entirely on the company’s affirmations that the merger price represented the fair value of shares, without requiring dissenters to present any additional “fair value” evidence.

3. Costs of the Interim Relief Application: At this stage and taking account that interim payments in the context of judicial proceedings initiated under Section 238 of the Cayman Merger Law are a new development, the Court decided not to grant the dissenters’ request that the company bear the costs of the application. However, in the future, it cannot be excluded that such request for costs be granted by the Court.

This is not intended to be a substitute for specific legal advice or a legal opinion. For specific advice, please contact:

Gary Smith

Ramona Tudorancea

In the previous issue of our series of legal insights on owning intellectual property (IP) through a Cayman Islands corporate structure, we presented a brief overview of the new trademark registration process introduced by the new Cayman Islands Trade Marks Law, 2016 and the Trade Marks Regulations, 2017 (see The New Cayman Islands Trademarks Regime). The new regime has now become effective as at 1st August 2017 (the “Effective Date“), and additional guidance has been released with respect to transitional provisions:

1. Existing Trade Marks: All existing trade marks will be considered as transferred to the new Register of Trade Marks until their scheduled renewal date, when they should be renewed in accordance with the New Trade Marks Regime. However, the Registrar is required to take the necessary steps to ensure that these existing trade marks are not inconsistent with the criteria for accepting registration of trade marks under the new law, i.e. that there are no absolute or relative grounds for refusal of registration. If there are grounds for refusal of registration, the registration of an existing trade mark may be declared invalid under Section 45 of the Trade Marks Law, 2016.

2. Expired or In-Abeyance Trade Marks: The trade marks which have expired prior to the Effective Date, and any trade marks currently held in abeyance for non-payment of annual fees will not be automatically transferred to the Register of Trade Marks, and owners of such trade marks are required to reapply to have their trade marks registered under the New Trade Marks Regime.

3. Transitional Provisions: All matters pending before the Court or the Registrar as at the Effective Date, for a decision on the basis of the previous trade mark registration regime will remain governed by the old law, as well as any infringement of a registered trade mark committed before the Effective Date.

This is not intended to be a substitute for specific legal advice or a legal opinion. For specific advice, please contact:

Ramona Tudorancea

E ramona.tudorancea@loebsmith.com

Statutory Remedies

The Foreign Judgments Reciprocal Enforcement Law (1996 Revision) (the “Law”) allows a judgment creditor to apply for the judgment to be registered in the Grand Court and thereafter is deemed to have the same force and effect as Judgment of the Grand Court. However, at present the Law extends only to the enforcement of Australian Judgments.

Common Law Remedies

All other foreign judgments must be enforced at common law. This includes judgments obtained in the United Kingdom and the United States. To do this, it is necessary to issue a writ of summons in the Grand Court to sue upon the foreign judgment and thereafter seek summary judgment. A foreign judgment will only be susceptible to enforcement in this way if it is final and conclusive (although this would appear to include summary and default judgments obtained in foreign jurisdictions). It is no longer necessary for a foreign judgment to be for a specified sum. In Badone v Sol Properties [2008] CILR, the Grand Court was willing to enforce a foreign judgment for specific performance of an agreement to transfer shares. Non-money foreign judgments would now appear to be capable of enforcement where is just to do so and such enforcement would not favour foreign litigants over domestic litigants, or undermine due process in the Cayman Islands. Further, in order for a foreign judgment to be enforced it will be necessary to satisfy the Grand Court that the foreign Court had jurisdiction over the defendant and that enforcement is not against public policy. For example, the Grand Court will not enforce judgments relating to foreign taxation. It is important to bear in mind that the enforcement of a foreign judgment at common law may require an application for leave to serve the defendant outside of the jurisdiction of the Cayman Islands.

This Briefing Note is not intended to be a substitute for specific legal advice or a legal opinion. For more specific advice on the enforcement of foreign judgments in the Cayman Islands, please contact:

Gary Smith

Ramona Tudorancea

E ramona.tudorancea@loebsmith.com

The protection of intellectual property (IP) rights in the Cayman Islands and in the British Virgin Islands (BVI) depends on the type of IP right (e.g. trademarks, patents and designs). The Cayman Islands and the BVI are British Overseas Territories and so the nature of IP protection in each jurisdiction is historically influenced by UK IP protection laws.

Which Agency administers Intellectual Property?

Cayman: Laws relating to IP in the Cayman Islands are administered by the Cayman Islands Intellectual Property Office (CIIPO).

BVI: Laws relating to IP in the BVI are administered by the BVI Office of the Registrar of Trade Marks, Patents & Copyright within the Registry of Corporate Affairs.

Types of Intellectual Property

Trademarks

Cayman Islands: Until 31 July 2017, the Cayman Islands offered trademark protection by way of extension of an existing UK trademark registration and also by the extension of an EU trademark registration; however, direct national filings in the Cayman Islands were not an option. For businesses (both local and foreign) whose interests were principally located in the Americas and the Caribbean, this resulted in increased trademark prosecution costs since they had to first secure protection in a foreign jurisdiction before they could apply in the Cayman Islands. In many cases such businesses would have had no bona fide intention to use the relevant mark in the first filing jurisdictions, thereby falling short of one of the requirements for UK trademark filings and calling into question the validity of the resulting registration of any extensions filed.

BVI: Until 31 August 2015, the BVI offered a dual trademark filing system under which trademark protection could be secured for goods and services on application to extend a UK trade mark registration to the BVI and/or, for goods only, on the filing of a trade mark application directly in the BVI.

Both jurisdictions modernized their trademark laws in 2015 (BVI) and 2017 (Cayman Islands) and as of 1 September 2015 (BVI) and 1 August 2017 (Cayman Islands) it is no longer possible to extend existing foreign trademark registrations to either jurisdiction. All existing trademark registrations were transferred over to the new registers. Since the implementation of the respective changes in law only the direct registration of trademarks in each jurisdiction is permitted.

Each jurisdiction now offers direct registration systems with some key common characteristics, including:

- the Nice Classification system as a mode of classifying goods and services under a trademark;

- multi-class filings;

- similar prosecution processes and formalities: filing, examination, acceptance, publication, registration;

- similar criteria for assessing the registrability of a trademark on both absolute and relative grounds;

- disclaimer and limitation practices as a condition to registration in certain cases;

- similar trademark opposition periods (three (3) months in the BVI and sixty (60) days in the Cayman Islands);

- provisions for the registration of certification and collective trademarks;

- an initial 10-year duration and renewal term.

Key Differences between Trademark Law and Practice in Cayman Islands and the BVI

- Neither the BVI nor the Cayman Islands is party to the Convention for the Protection of Industrial Property signed in Paris on 20 March 1883, as revised or amended from time to time (Paris Convention). But BVI laws allow for the filing of priority-based applications where there is an earlier application in a Paris Convention country and the BVI application is filed within six (6) months of the filing date of the priority application. The BVI also allows for priority-based applications on the basis of an earlier application in a World Trade Organisation member country within the same six-month window.

- The BVI allows for cases of trademark infringement to be brought on the basis of a trademark entitled to protection under the Paris Convention as a well-known trademark; the defensive registration of well-known trademarks is also allowed.

- Whilst both the Cayman Islands and the BVI follow the Nice Classification when examining specifications of goods and services, office actions based on specification queries are more commonly issued in the Cayman Islands where terms from WIPO’s Nice Classification database and the Harmonised List of the EUIPO TMclass database are not used (terms from these lists are automatically accepted). Class headings are also accepted in the Cayman Islands subject to certain general indications as outlined in Practice Note 02/2017 issued by the CIIPO.

- Trademarks which are not put to genuine use in the BVI within three (3) years of the date of registration are subject to revocation where there is no valid reason for non-use. There is no procedure to revoke a trademark registration in the Cayman Islands on grounds of non-use, although revocation actions may be brought on other grounds (for example, where a particular trademark no longer functions as a trade mark on its becoming common in the trade).

- Series marks registered under the repealed trademarks law in the Cayman Islands must be divided into individual trade mark registrations on or before the next renewal date. The current trademarks law does not allow for the filing of series marks. However, the BVI legislation does allow for the registration of series marks.

- Annual fees fall due every 1 January in the Cayman Islands for the life of a trademark registration. Where annual fees are unpaid by 31 March of each year, the rights protected by the registration are in abeyance until annual fees and late penalty fees are paid up to date. This means that registered rights cannot be enforced against third parties until all annual fees and late fees are paid up to date as registered rights are not considered to be in good standing. The BVI does not have an annual fees regime for trademarks.

Designs

Proprietors of UK-registered designs enjoy the same rights and privileges in the BVI as they do in the UK without any need to re-register. Designs registered in the UK automatically extend to the BVI for the life of the UK registration. Local publication of the design in the BVI is nevertheless advisable to put the public on notice of rights in and to the registered design.

Prior to 1 August 2017 there was no protection for designs in the Cayman Islands. On 1 August 2017, the Cayman Islands introduced an indirect registration process. The Design Rights Registration Act, 2016 enables proprietors of UK and EU Registered Design Rights to extend their Registered Design Rights to the Cayman Islands and renew such rights for so long as they are renewed and valid in the UK or EU respectively. There is no substantive examination, and no opposition or invalidation procedure. However, there is a requirement to pay annual fees every 1 January for the life of the registration and, where unpaid for more than 12 months, registrations are liable to cancellation by the Registrar.

Most recently, the Designs Rights Act, 2019 was passed in the Cayman Islands to allow for the direct registration of designs. Designs are defined therein as “the design of the shape or configuration (whether internal or external) of the whole or part of an article”. This legislation is not yet in practical effect.

Patents

Both the BVI and the Cayman Islands allow for the indirect registration of patents. Once a UK or EP(UK) patent is granted, an application can be made in either jurisdiction to extend the scope of protection. In the Cayman Islands, there is no deadline for the filing of the application to extend rights, whereas in the BVI, rights must be extended within three (3) years from the date of issue of the UK patent. The length of protection in each jurisdiction once rights are extended or re-registered is dependent on that of the underlying UK or EP(UK) patent. If the underlying patent expires or becomes invalidated, so does the corresponding patent in each jurisdiction.

In the Cayman Islands, an annual fee must be paid for the life of the patent in order to keep registered rights in good standing. A default in the payment of the annual fee causes registered rights to be held in abeyance until all annual fees and, including any penalties for late payment, are paid up to date. Furthermore, default in the payment of the annual fees and penalties for more than 12 months may result in registered rights being cancelled by the Registrar. In the BVI, each time an annuity or renewal fee is paid in the UK in respect of a patent that has been extended to the BVI, certified proof of same should be provided to the BVI Registry along with payment of the corresponding local renewal fee.

The Cayman Islands legislation also includes some anti-patent trolling provisions to prevent abuse by patent trolls (otherwise called Patent Assertion Entities). A patent troll is a person or entity which holds and enforces patents in an aggressive and opportunistic manner, often with no intention of marketing or promoting the subject of the patent. In other jurisdictions, particularly in the U.S.A., the activities of patent trolls have imposed considerable economic burdens on the creative pursuits of others involved in development and commercial exploitation of IP. The experience in those jurisdictions is that software patents are particularly prone to such abuse. The anti-patent trolling provisions of the Cayman Islands’ patent legislation are designed to limit persons from making assertions of patent infringement in bad faith. In addition to the general prohibition on such bad-faith assertions, the legislation includes a statutory remedy for those aggrieved by the actions of patent trolls. Furthermore, the Cayman courts will not recognise or enforce a foreign judgment to the extent the claim is based on an assertion of patent infringement made in bad faith.

Notably, the BVI also has a Patents Act (Revised 2020) that allows for the direct registration of patents. However, applications for such patents are not currently accepted by the Registry in practice and this is unlikely to change in the near future.

Copyright

An amended version of the UK’s Copyright Act of 1956 was extended to the BVI under The Copyright (Virgin Islands) Order 1962 and continues to be in effect today. Until 30 June 2016, copyright protection in the Cayman Islands was also by way of extension of the UK’s 1956 Act via the Copyright (Cayman Islands) Order 1965 (the 1965 Order). However, on 30 June 2016, Part 1 of the UK’s Copyright, Designs and Patents Act 1988, subject to certain exclusions and modifications, was extended to the Cayman Islands. This was a significant development for the Cayman Islands, and the first step in the Cayman Islands’ Government’s plans to reform and modernize intellectual property laws generally.

In keeping with the approach taken by the UK and many other countries around the world, no copyright registration procedure is in place in either jurisdiction. Instead, protection arises automatically once the work is recorded, in writing or otherwise.

Conclusion

The recent development of IP laws in the Cayman Islands and the BVI has significantly increased the ability of businesses, entrepreneurs and developers of new technology (for example, with respect to Blockchain technology) to protect, exploit and enforce their IP rights.

Further Assistance

This publication is not intended to be a substitute for specific legal advice or a legal opinion. If you require further advice relating to the matters discussed in this Legal Insight, please contact us. We would be delighted to assist.

E: gary.smith@loebsmith.com

E: robert.farrell@loebsmith.com

E: ivy.wong@loebsmith.com

E: edmond.fung@loebsmith.com

E: elizabeth.kenny@loebsmith.com

E: cesare.bandini@loebsmith.com

E: vivian.huang@loebsmith.com

E: faye.huang@loebsmith.com

E: yun.sheng@loebsmith.com