About Loeb Smith

People

Sectors

Expertise

- Legal Service

- Banking and Finance

- Blockchain, Fintech and Cryptocurrency

- Capital Markets and Privatization

- Corporate

- Cybersecurity and Data Privacy

- Insolvency, Restructuring and Corporate Recovery

- Insurance and Reinsurance

- Intellectual Property

- Investment Funds

- Litigation and Dispute Resolution

- Mergers and Acquisitions

- Private Client and Family Office

- Private Equity and Venture Capital

- Governance, Regulatory and Compliance

- Entity Formation and Managed Services

- Consulting

- Legal Service

News and Announcements

Locations

Subscribe Newsletters

Contact

Many thanks to our readers and to our contributing author colleagues for making it possible! Our firm has been ranked as Lexology Legal Influencer for Private client – Central and South America for Q3 2025. This is the third ranking from Lexology this year – here to many more to come 🤜

Thrilled to share that Loeb Smith has won Law Firm of the Year: Client Service at last week’s Hedgeweek® US Awards 2025!

Robert Farrell and Juliette Schembri were present at the event in hashtagNYC to accept the award and celebrate this success. This award reflects our corporate group’s dedication to providing outstanding client service to our clients across the globe every step of the way across their matters. This award inspires us to keep pushing forward, growing stronger, and delivering effective legal advice and solutions to our clients. Global Vision. Client Focus. 🥳 🎉 🥂

Thank you to our clients and colleagues who make this possible and congratulations to all winners and nominees!

The Cayman Islands Monetary Authority (the “Authority”) has announced the launch of its One-time Non-Compliant Directors’ Amnesty Scheme (“Scheme”) – a limited opportunity for eligible registered directors to voluntarily settle outstanding annual fees and accrued penalties at a discounted rate.

According to the Authority’s announcement, “this initiative reflects the Authority’s commitment to supporting good governance and regulatory compliance, while also recognising the practical challenges that may have contributed to past non-compliance. By offering this limited-time opportunity, the Authority seeks to help directors return to good standing and ensure the continued integrity of the jurisdiction’s regulatory framework.”

The Scheme will run from 16 September to 15 October 2025 and is open to registered directors within the 1–19 covered entities category, who as of 31 August 2025, have more than two years of unpaid annual fees. It provides these directors with the opportunity to regularise their status under the Directors Registration & Licensing Act, 2014 (“DRLA”). The announcement clarifies that directors currently under investigation or subject to enforcement action by the Authority or another regulatory body are not eligible.

Apparently, the Authority has contacted Directors who meet the criteria directly via email with the relevant participation instructions. If you believe you may be eligible but did not receive a notification, please contact the Authority at amnesty@cima.ky.

Applications under this scheme will only be accepted through the Directors’ Gateway Portal at https://gateway.cimaconnect.com. Eligible directors should log in to the portal to review and confirm their status in preparation for the launch of the Scheme. Further details are available on the portal effective 16 September 2025.

The Authority is encouraging Directors wishing to return to good regulatory standing to take advantage of this 30-day window. Once the Scheme closes, the full fees and penalties will apply without exception.

The Ministry of Financial Services & Commerce released a Consultation Paper on 26 August 2025 of amendments to introduce tokenized funds in the Cayman Islands, along with amendment bills (“Amendment Bills”) to each of the Mutual Funds Act, Private Funds Act, and the Virtual Asset (Service Providers) Act (“VASP Act”) (together, the “Acts”).

The Consultation Paper and proposed legislative changes set out in the Amendment Bills follow a much welcome amendment to the VASP Act passed in May 2025, which paved the way for tokenized funds in the Cayman Islands, by materially revising the definition of “issuance of virtual assets” to exclude both (i) the issuance of equity interests under the Mutual Funds Act, and (ii) investment interests under the Private Funds Act, from the requirement to register under the VASP Act. Please see our Legal Insight from 24 July 2025 for further detail.

Now, the Amendment Bills are designed to provide further regulatory certainty to (i) adapt the Acts so that they explicitly cover tokenized funds and address the additional specific considerations that apply to a tokenized fund e.g. custody arrangements, and (ii) ensure that the Cayman Islands Monetary Authority (“CIMA”) has sufficient powers to effectively supervise tokenized funds.

Key changes

The ten (10) key takeaways of the Amendment Bills are as follows.

-

- They introduce new defined terms into each of the Acts to clearly distinguish tokenized funds.

- They clarify that digital equity or investment tokens must convey the same rights and privileges as traditional non-tokenized equity or investment interests.

- The operators of a tokenized fund must ensure that (i) adequate records relating to the creation, sale, transfer and ownership of digital equity tokens/ digital investment tokens are maintained and available for inspection by CIMA within 24 hours of any such request (ii) the tokenized fund must have staff who possess the necessary skills, knowledge and experience, and (iii) the tokenized fund must maintain adequate capital and cybersecurity measures.

- Requirement to appoint an Administrator/ additional obligations of the Administrator:

- Private Fund – Whereas there is currently no statutory requirement in the Private Funds Act for a non-tokenized private fund to appoint a third party Administrator, the Amendment Bill to the Private Funds Act requires a tokenized private fund to appoint an Administrator who is licensed by CIMA and acts as the principal office of the tokenized private fund.

- Mutual Fund – While there is currently no specific requirement in the Mutual Funds Act which mandates that the Administrator appointed by a regulated non-tokenized mutual fund must be a CIMA licensed fund Administrator (i.e. a foreign Administrator can be appointed), the Amendment Bill to the Mutual Funds Act requires the Administrator appointed by a tokenized mutual fund to be a CIMA licensed Administrator, which shall also act as the principal office to the tokenized mutual fund.The Amendment Bill to the Mutual Funds Act also increases the obligations that apply to a CIMA licensed fund Administrator. For example, the proposed amendment to section 16(d) of the Mutual Funds Act set out in the applicable Amendment Bill states that a CIMA licensed mutual fund Administrator shall not provide mutual fund administration to a tokenized mutual fund, unless (i) the issuance, redemption and transfer of digital equity tokens comply with the terms of the offering document, (ii) all records relating to the creation, sale, transfer and ownership of digital equity tokens are securely maintained and available to CIMA within 24 hours of request, (iii) the tokenized mutual fund is staffed with staff who possess the necessary skills, knowledge and experience and has appropriate facilities, books, records and accounting systems, capital and cybersecurity measures, and (iv) the tokenized mutual fund has complied with every other requirement under the Mutual Funds Act (as amended).

- Any risks specific to the digital equity tokens/ digital investment tokens, including considerations regarding cybersecurity, the liquidity of the digital equity tokens/ digital investment tokens to be issued by a tokenized fund should be disclosed in the offering document, along with details of any measures to mitigate such risks.

- They add a requirement for a tokenized fund to notify CIMA if it is not able to meet its obligations to tokenholders.

- The operator of a tokenized fund must ensure that digital equity tokens/ digital investment tokens are held in secure custody and in a manner to protect the interests of the tokenholders.

- The audit of a tokenized fund by an independent auditor shall include (i) an analysis of the digital equity token’s/ digital investment token’s design, creation, supply and distribution, as well as the processes and controls which govern the digital investment tokens, (ii) an information technology security audit, and (iii) any features of programmable contracts or self-executing contracts.

- The independent auditor is also required to confirm as part of the audit of a tokenized fund that (i) no fraudulent transactions have been identified during the audit, (ii) all digital equity tokens/ digital investment tokens created and issued are backed effectively by underlying assets, and (iii) to include a statement of compliance of the tokenized fund with all applicable custody, cybersecurity and risk management measures issued by CIMA.

- They grant CIMA supervisory powers including the power to carry out inspections of the underlying technology, digital equity tokens/ digital investment tokens and underlying asset valuations.

Conclusion and next steps

The Consultation Paper and Amendment Bills provide much needed legal clarity and modernization of the existing Cayman Islands legal and regulatory framework to effectively “catch-up” with the evolving technology developments in the financial and digital assets industry.

The Consultation Paper (including Amendment Bills) are subject to any comments or feedback from industry stakeholders by 12 September 2025 and given the subject matter of the Amendment Bills, it is likely that further regulatory measures will be issued by CIMA in relation to tokenized funds to provide further guidance.

Further Assistance

This publication is not intended to be a substitute for specific legal advice or a legal opinion. For specific advice on the matters covered in this Legal Briefing, please contact your usual Loeb Smith attorney or any of the following:

E: gary.smith@loebsmith.com

E: robert.farrell@loebsmith.com

E: elizabeth.kenny@loebsmith.com

E: vanisha.harjani@loebsmith.com

In the prevailing economic conditions investors in offshore companies registered in the Cayman Islands or the British Virgin Islands (“BVI”) are increasingly being forced to consider their rights against directors who may have been responsible for mismanagement of the company’s affairs. Minority shareholders, in particular, are keen to understand the availability of remedies which allow them to overcome “wrongdoer control.” That is to say, the common situation where the composition and direction of the board is controlled by majority shareholders. We have set out below a brief summary of the duties owed by directors and the remedies available to shareholders in each of these two jurisdictions.

What is scope of director’s duties?

Cayman Islands

The duties of a director of a Cayman company are found in the common law and include the duty to act bona fide in the best interests of the company, a duty not to exercise his or her powers for purposes for which they were not conferred and not to make secret profits.

BVI

The law governing the duties of directors and conflicts is set out in the BVI Business Companies Act (as revised) (the “Act”). These largely mirror the position at common law and include, for example:

-

- the duty to “act honestly and in good faith and in what the director believes to be in the best interests of the company”;

- the duty to exercise powers “for a proper purpose” and a requirement that a director “shall not act, or agree to the company acting, in a manner which contravenes this Act or the memorandum or articles of the company”; and

- a requirement that a director “shall, forthwith after becoming aware of the fact that he or she is interested in a transaction entered into or to be entered into by the company, disclose the interest to the board of the company.”

It is interesting to note that the Act provides that a director of a company that is a wholly-owned subsidiary, subsidiary or joint venture company may, subject to certain requirements, act in the best interests of the relevant parent, or in the case of the joint venture company, the relevant shareholders even though such act may not be in the best interests of the company of which they are a director.

What are the standard director’s duties?

Cayman Islands

While the decisions of English common law cases are not binding in the Cayman Islands, they are persuasive authority. Accordingly, a large body of the English caselaw authority on a director’s duties has been followed by the Cayman Islands court and applies to the Cayman Islands such that a director is under a duty to act with reasonable care, skill and diligence in the performance of his or her duties. In the English authority of Re City Equitable Fire Insurance Co [1925] Ch. 407 it was held that “a director need not exhibit in the performance of his duties a greater degree of skill than may reasonably be expected from a person of his knowledge and experience. This highly subjective test, however, has been met with increasing criticism in more recent years and there is further English caselaw authority to suggest that directors are nevertheless subject to an objective duty to “take such care as an ordinary man might be expected to take on his own behalf” (Dorchester Finance Co v Stebbing [1989] BCLC 498 (decided in 1977)). As such, a distinction appears to be drawn between the duty of skill on the one hand and the duty to take care on the other. However, in Re City Equitable Fire Insurance Co it was further held that “in respect of all duties that, having regard to the exigencies of business, and the articles of association, may be properly left to some other official, a director is, in the absence of grounds for suspicion, justified in trusting to that official to perform such duties honestly.”

BVI

In terms of the standard of care that directors of BVI companies must show, the Act provides that a director “when exercising powers or performing duties as a director, shall exercise the care, diligence, and skill that a reasonable director would exercise in the same circumstances taking into account, but without limitation-

-

- the nature of the company;

- the nature of the decision; and

- the position of the director and the nature of the responsibilities undertaken by him or her.”

This duty is qualified in the Act to the extent that the director of a company is entitled to rely upon the books, records and financial statements of the company in question and/or employees and professional advisers provided that in doing so he or she acts in good faith, undertakes a proper inquiry where this is warranted and has no knowledge of a reason for not placing reliance on the said documents.

What are the key remedies available to a member or shareholder?

Cayman Islands

The following remedies are available to a member of a Cayman company:

-

- A personal action against the company (where the company has breached a duty which is owed to the member personally);

- A representative action (similar to a personal action such a claim would lie for breach of a duty owed to a group of shareholders);

- A derivative, or multiple derivative claim (this is the most common type of action. See below); or

- A petition to wind up the company on just and equitable grounds. (This is seen as a last resort because it risks placing the company into liquidation although the Cayman Companies Act (As Revised) (the “Companies Act”) provides the Court with the option of making an alternative order. See below).

BVI

The members of a BVI company may pursue the following remedies:

-

- A personal action (on the same grounds as at common law in the Cayman Islands);

- A representative action which provides that the Court may appoint a member “to represent all or some of the members having the same interest and may, for that purpose, make such order as it thinks fit”. An order would include an order “as to the control and conduct of the proceedings” and “directing the distribution of any amount ordered to be paid by a defendant in the proceedings among the members represented.”;

- A derivative claim; or

- An unfair prejudice claim.

The most common type of remedies sought by minority shareholders are derivative claims and unfair prejudice claims (see below).

What are derivative claims and what is their legal basis?

Cayman Islands

A derivative action is a claim commenced by one or more minority shareholders on behalf of a company of which they are a member in respect of loss or damage which that company has suffered. Such a claim can only be brought in certain circumstances and amounts to an exception to the rule that a company, as a separate legal person, should sue and be sued in its own name (often referred to as the rule in the English authority of Foss v Harbottle (1843) 2 Hare 461; 67 E.R 189). In the Cayman Islands the law governing derivative actions is drawn from the common law rather than statute.

BVI

While the English common law applies in the BVI, members’ remedies have been given a statutory footing in the Act (see below).

What is the procedure for commencing a derivative action?

Cayman Islands

As with the majority of actions commenced in the Cayman Islands, derivative claims are normally begun by serving a writ and statement of claim on the relevant defendant or defendants. Grand Court Rules O.15, r. 12A provides that where the defendant gives notice of an intention to defend the claim then the plaintiff must apply to the court for leave to continue the action. Such an application should be supported by affidavit evidence verifying the facts on which the claim and entitlement to sue on behalf of the company are based. Pursuant to Grand Court Rules O.15 r.12A(8) on the hearing of the application, the court may grant leave to continue the action for such period and upon such terms as it thinks fit, dismiss the action, or adjourn the application and give such direction as to joinder of parties, the filing of further evidence, discovery, cross-examination of deponents and otherwise as it considers expedient. In Renova Resources Private Equity Limited v Gilbertson and Others [2009] CILR 268, Foster., J affirmed the application in the Cayman Islands of the test to be applied in determining whether to grant leave to continue the action put forward by the English Court of Appeal in Prudential Assurance Co Ltd v Newman Industries Ltd (No.2) [1981] Ch 257. Foster, J., held that: “(…) there are two elements to this: first the plaintiff [is] required to show prima facie that there [is] a viable cause of action vested in the company and, secondly, that the alleged wrongdoers [have] control of the company (or could block any resolution of the company or the board) and thereby prevent the company bringing an action against themselves.”

BVI

The Act provides that subject to certain exceptions, “the Court may, on the application of a member of a company, grant leave to that member to-

-

- bring proceedings in the name and on behalf of that company; or

- intervene in proceedings to which the company is a party for the purpose of continuing, defending or discontinuing the proceedings on behalf of the company.”

Without limiting the above, in determining whether to grant leave, “the Court must take the following matters into account-

-

- whether the member is acting in good faith;

- whether the derivative action is in the interests of the company taking account of the views of the company’s directors on commercial matters;

- whether the proceedings are likely to succeed;

- the costs of the proceedings in relation to the relief likely to be obtained; and

- whether an alternative remedy to the derivative claim is available.”

It should be noted that leave to bring or intervene in proceedings may be granted “only if the Court is satisfied that-

-

- the company does not intend to bring, diligently continue or defend, or discontinue the proceedings, as the case may be; or

- it is in the interests of the company that the conduct of the proceedings should not be left to the directors or to the determination of the shareholders or members as a whole.”

Is it possible to bring multiple derivative claims (“MDCs”)?

Cayman Islands

In Renova the Grand Court held that in appropriate circumstances MDCs would be permitted. In that case, the plaintiff had brought an action in respect of loss incurred by a wholly-owned subsidiary of the company in which it was a shareholder and therefore loss to the subsidiary caused indirect loss to its parent company and shareholders. However, the rule against the recovery of reflexive loss applied such that a shareholder or parent company would not be permitted to claim for indirect losses which mirrored those losses suffered directly by the relevant subsidiary or indeed sub-subsidiary on whose behalf action was being brought.

BVI

In Microsoft Corporation v Vadem Ltd[1] the Court of Appeal of the Eastern Caribbean Supreme Court held that BVI law which has been codified in this area “does not permit double derivative proceedings.” That said, English caselaw authority such as Universal Project Management Services Ltd v Fort Gilkicker Ltd[2] may open up arguments that such actions are nevertheless available in the jurisdiction at common law.

What remedies are available for unfair prejudice and what is their legal basis?

Cayman Islands

Pursuant to the Companies Act the court may wind up a company if it is of the opinion that it would be just and equitable for it to do so. The Companies Act provides that where such a petition is presented by members of the company as contributories on the ground that it is just and equitable that the company should be wound up, the Court shall have jurisdiction to make the following orders, as an alternative to a winding-up order, namely:

-

- an order regulating the conduct of the company’s affairs in the future;

- an order requiring the company to refrain from doing or continuing an act complained of by the petitioner or to do an act which the petitioner has complained it has omitted to do;

- an order authorising civil proceedings to be brought in the name of and on behalf of the company by the petitioner on such terms as the Court may direct; or

- an order providing for the purchase of the shares of any members of the company by other members or by the company itself and, in the case of a purchase by the company itself, a reduction of the company’s capital accordingly.

BVI

The Act provides that a member “who considers that the affairs of the company have been, are being or are likely to be, conducted in a manner that is, or any act or acts of the company have been, or are, likely to be oppressive, unfairly discriminatory, or unfairly prejudicial to him or her in that capacity, may apply to the Court for an order”. If on an application “the Court considers it just and equitable to do so, it may make such order as it thinks fit, including, without limiting the generality of this subsection, one or more of the following orders:

-

- in the case of a shareholder, requiring the company or any other person to acquire the shareholder’s shares;

- requiring the company or any other person to pay compensation to the member;

- regulating the future conduct of the company’s affairs;

- amending the memorandum and articles of the company;

- appointing a receiver of the company;

- appointing a liquidator of the company;

- directing the rectification of the records of the company; and

- setting aside any decision made or action taken by the company or its directors in breach of this Act or the memorandum or articles of the company.”

Further Assistance

This publication is not intended to be a substitute for specific legal advice or a legal opinion. For specific advice on the matters covered in this Legal Briefing, please contact your usual Loeb Smith attorney or any of the following:

E: gary.smith@loebsmith.com

E: robert.farrell@loebsmith.com

E: edmond.fung@loebsmith.com

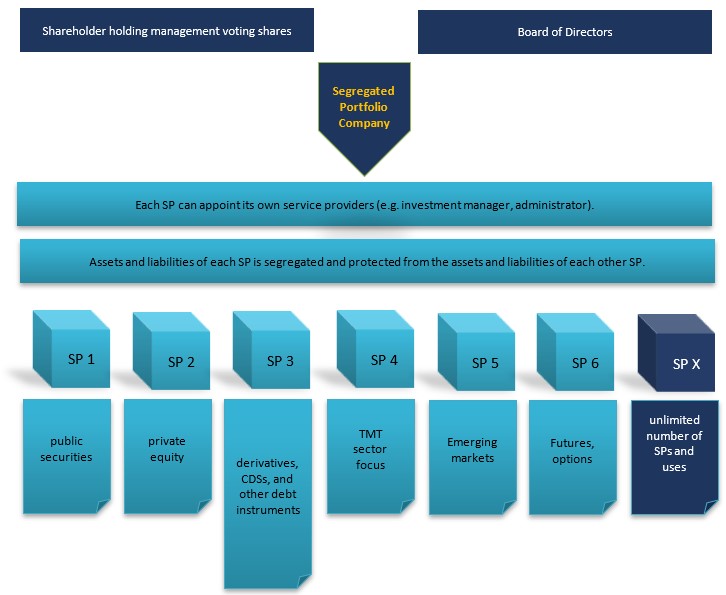

Once registered under the Cayman Islands Companies Act (As Revised), a segregated portfolio company (“SPC”) can operate segregated portfolios (“SPs”) with the benefit of statutory segregation of assets and liabilities between portfolios. The principal advantage of an SPC over a standard exempted company is to protect the assets of one portfolio from the liabilities of other portfolios.

The benefits of SPCs

The SPC corporate structure is frequently used for multi-strategy hedge funds, umbrella funds and master-feeder structures owing to the various benefits of the SPC structure.

- SPC provides ability to set up a statutory “ring-fence” to protect against cross liability issues relating to the assets and liabilities of the various SPs within a SPC.

- The annual Government fees for an SP is less than 50% less than the annual Government fees for an exempted company.

- The SPC is a Cayman corporate structure, like a standard exempted company, where there are no residency restrictions on Directors or Shareholders.

- There are no exchange control restrictions.

- There are no Cayman taxes on the SPC or its shareholders, among other benefits.

- As shown in figure 1 below, the SPC structure is used increasingly as an investment platform on which investors can use different SPs to hold varying asset classes (e.g. real estate, intellectual property, stocks and shares, and distressed assets) and have their investments managed separately from other investments held by other SPs on the same SPC platform.

Figure 1. An unlimited number of SPs can be created by the SPC to hold various assets, employ different investment strategies or have varying sector focus.

What are the features of a Segregated Portfolio Company?

- Under Cayman Companies Act, an SPC is an exempted company which has been registered as a segregated portfolio company. It has full capacity to undertake any object or purpose subject to any restrictions imposed on the SPC in its Memorandum of Association (“Memorandum”). The Memorandum of an SPC usually gives the SPC full capacity to pursue very broad objects. For example, the Memorandum of an SPC typically has a clause such as this (emphasis added):“The objects for which the Company is established are unrestricted and the Company shall have full power and authority to carry out any object not prohibited by the Companies Act…or any other law of the Cayman Islands.”

- Cayman Companies Act permits an SPC to create one or more SPs in order to segregate the assets and liabilities of the SPC held within one SP from the assets and liabilities of the SPC held within another SP of the SPC.

- The general assets and general liabilities of the SPC (i.e. assets and liabilities which cannot be properly attributed to a particular SP) are held within a separate general account rather than in any of the SP accounts.

- The Companies Act requires an SPC to make a distinction between “segregated portfolio assets” (which are assets of the SPC that have been designated or allocated for the account of a particular SP) and general assets (which are assets of the SPC that have not been designated or allocated for the account of any particular SP of the SPC). Each SP should have, as appropriate, its own bank account, brokerage account, and other accounts to hold its assets to avoid co-mingling with the assets of other SPs.

- How are SP assets comprised? – The assets of an SP comprise (a) assets representing the share capital and reserves (“reserves” include profits, retained earnings, capital reserves and share premiums) attributable to the SP; and (b) all other assets attributable to or held within the SP (e.g. bonds, stocks, real estate, IP). Shares of the SPC are permitted to be issued in respect of a particular SP, the proceeds from the issue of such shares are included in the assets of that SP and the shares may carry the right to distributions from that SP. The proceeds of the issue of shares which are not segregated portfolio shares shall be included in the SPC’s general assets.

- The Companies Act also requires an SPC to make a distinction between “segregated portfolio liabilities” (which are liabilities of the SPC that have been designated or allocated for the account of a particular SP of the SPC) and general liabilities (which are liabilities of the SPC that have not been designated or allocated for the account of any particular SP of the SPC).

- It is the duty of the Directors of the SPC to establish and maintain (or cause to be established and maintained) procedures:

(a) to segregate, and keep segregated, portfolio assets separate and separately identifiable from general assets;

(b) to segregate, and keep segregated, portfolio assets of each SP separate and separately identifiable from segregated portfolio assets of any other SP; and

(c) to ensure that assets and liabilities are not transferred between SPs or between an SP and the general assets otherwise than at full value. - Who controls the SPC? – The SPC will have a Board of Directors. In addition, each SP can have its own segregated portfolio directorate or investment or management committee which effectively controls and manages the operations of the relevant SP. The segregated portfolio directorate, investment or management committee would obtain its powers through powers delegated to it by the Board of Directors of the SPC.

- Contracting on behalf of an SP – Whilst the SPC is a company and therefore a corporate entity with separate legal personality, an SP does not have separate legal personality. Accordingly, the Companies Act requires that when contracting on behalf of a particular SP, it should be made clear which SP the SPC is contracting on behalf. Each SP can have its own investment manager, trading advisor, and other service providers but it should be made clear in the agreements which SP of the SPC has engaged them for their services. For example, if ABC Investments SPC enters into a trading advisory agreement to engage a trading advisor for segregated portfolio A1, the SPC should make it clear in the agreement that it is acting as: “ABC Investments SPC acting solely for and on behalf of segregated portfolio A1”. The trading agreement should also be executed as: “ABC Investments SPC acting solely for and on behalf of segregated portfolio A1”.

- Who can bind an SPC or an SP? – The SPC has the capacity to enter transactions “acting solely for and on behalf” of one or more SPs as stated above, the SPC must identify the relevant SP and state that it is: “acting solely for and on behalf of” the particular named SP. It is the Board of Directors of the SPC (or other person to whom the Directors have delegated authority, e.g. the investment manager) that will be able to bind the SPC and the relevant SP in respect of which the SPC is acting.

- Directors at SP level? – There will not be a Board of Directors as such at the SP level because it is not a separate corporate entity. However, often the Board of Directors of the SPC in a fund structure will delegate management of the SPC and/or the SPs to an investment manager or to an investment or management committee.

- Can assets be transferred between SPs? – The Companies Act requires the Directors of the SPC to ensure that assets and liabilities are not transferred between SPs otherwise than at full value

- Rights of creditors – The Companies Act requires that segregated portfolio assets must only be available and used to meet liabilities to the creditors of the SPC who are creditors in respect of that SP and who shall thereby be entitled to have recourse to the segregated portfolio assets attributable to that SP for such purposes. Segregated portfolio assets should not be available or used to meet liabilities to, and shall be absolutely protected from, the creditors of the SPC who are not creditors in respect of that SP, and who accordingly shall not be entitled to have recourse to the segregated portfolio assets attributable to that SP.

Accordingly, a creditor will only have recourse to assets from SPs with which it has contracted and creditors will have no recourse to the assets of other SPs of the SPC which are protected under the Companies Act. This statutory protection afforded under the Companies Act to the assets of each SP is one of the key feature and benefit of the SPC structure.

- Transfers to General Assets to meet expenses – Sometimes the Articles of Association of the SPC empowers the Directors of the SPC to transfer segregated portfolio assets to the general assets of the SPC (and, if more than one SP is in existence, pro rata in proportion to the net asset value of each SP or in such other proportion as the Directors determine) in order to discharge the following liabilities: government registration fees, annual return fees, professional fees, service provider fees, taxes, fines and penalties and any other liabilities or a recurring nature necessarily incurred in maintaining the continued existence and good standing of the SPC.

- Segregation of Liabilities and rights of third parties – The liabilities to a person arising from a matter imposed on, or attributable to, a particular SP, only entitle that person to have recourse to that particular SP in the first instance and then to the general assets of the SPC, unless the Articles of Association of the SPC prohibits payments from the general assets of the SPC, in which case there is no recourse to the general assets.

Further Assistance

This publication is not intended to be a substitute for specific legal advice or a legal opinion. If you require further advice relating to the topic covered in this Briefing, please contact us. We would be delighted to assist.

E: gary.smith@loebsmith.com

E: robert.farrell@loebsmith.com

E: elizabeth.kenny@loebsmith.com

E: vanisha.harjani@loebsmith.com

E: vivian.huang@loebsmith.com

E: faye.huang@loebsmith.com

E: yun.sheng@loebsmith.com

OPEN-ENDED FUNDS

The Mutual Funds Act (for open-ended funds) and the Private Funds Act (for closed-ended funds) are the two main statutes relevant to the regulation of investment funds in the Cayman Islands. The Cayman Islands Monetary Authority (“CIMA”) is the regulatory body responsible for compliance with these laws and related regulations and has broad powers of enforcement.

The Mutual Funds Act defines a mutual fund as “a company, unit trust or partnership that issues equity interests, the purpose or effect of which is the pooling of investor funds with the aim of spreading investment risks and enabling investors in the mutual fund to receive profits or gains from the acquisition, holding, management or disposal of investments but does not include a person licensed under the Banks and Trust Companies Act (2021 Revision)…” The reference to “equity interests” means that debt instruments (including warrants, convertibles and sukuk instruments) are excluded and funds issuing such instruments will not be required to register with CIMA as a mutual fund.

Limited Investor Funds:

The scope of regulation extends to Cayman Islands incorporated or established master funds that have one or more CIMA-regulated feeder funds and hold investments and conduct trading activities. Changes to the Mutual Funds Act means that certain mutual funds, which were previously exempted from registration with CIMA because they had 15 investors or less, the majority of whom have the power to appoint and/or remove the operators of the investment fund (the operator being the directors, the general partner or the trustee, as is relevant given the corporate structure used for the fund) (“Limited Investor Funds”), are no longer exempt from registration with CIMA. Limited Investor Funds are now required to be registered with, and are regulated by, CIMA.

Audit Requirement:

Each CIMA registered mutual fund is required to have its accounts audited annually and filed by a firm of auditors on the CIMA approved list of auditors with CIMA within six (6) months of the end of each financial year of the mutual fund (along with a Financial Annual Return in CIMA’s prescribed form).

Single Investor Funds:

Mutual funds that are established for a sole investor and do not involve the pooling of investor funds fall outside the regulatory framework of the Mutual Funds Act. Nonetheless, a mutual fund with a single investor can apply for voluntary registration to, among other things, benefit from the status of being a regulated fund.

Cayman Islands laws and regulations do not impose restrictions on, or prescribe rules for investment strategies of open-ended funds, or their use of leverage, shorting or other techniques.

Registration of Directors:

Directors of mutual funds structured as exempted companies, managers of investment funds structured as LLCs and directors of general partners of investment funds structured as an exempted limited partnership (in each case, wherever in the world these persons are located, not just Cayman Islands-based directors) regulated by CIMA are required to register with CIMA under the Directors Registration and Licensing Act (DRLA). The DRLA enables CIMA to verify certain information in respect of directors or managers of CIMA-registered funds. There is currently no requirement for registration of directors with CIMA under the DRLA who are directors of closed-ended funds that fall within the scope of the Private Funds Act. However, this may change in the future.

CLOSED-ENDED FUNDS

The Private Funds Act requires the registration of closed-ended funds (typically, investment funds that do not grant investors with a right or entitlement to withdraw or redeem their shares or interests from the fund upon notice) with CIMA. The Private Funds Act applies to private equity funds, real estate funds, venture capital funds, and the other types of closed-ended funds set up as Cayman Islands limited partnerships, companies (including SPCs), unit trusts and limited liability companies. The Private Funds Act also applies to non-Cayman Islands private funds carrying on business or attempting to carry on business in or from the Cayman Islands.

In addition to registration with CIMA, the Private Funds Act also imposes the following regulatory requirements to be met by private funds:

Audit

Each private fund is required to have its accounts audited annually and filed by a firm of auditors on the CIMA approved list of auditors with CIMA within six (6) months of the end of each financial year of the private fund (along with a financial annual return in CIMA’s prescribed form).

Valuation of assets

A private fund must have appropriate and consistent procedures for the purposes of proper valuations of its assets, which ensures that valuations are conducted in accordance with the requirements in the Private Funds Act. Valuations of the assets of a private fund are required to be carried out at a frequency that is appropriate to the assets held by the private fund and, in any case, on at least an annual basis.

Safekeeping of fund assets

The Private Funds Act requires a custodian: (1) to hold the private fund’s assets that are capable of physical delivery or capable of registration in a custodial account except where that is neither practical nor proportionate given the nature of the private fund and the type of assets held; and (2) to verify title to, and maintain records of, fund assets.

Cash monitoring

The Private Funds Act requires a private fund to appoint an administrator, custodian or another independent third party (or the manager or operator of the private fund):

-

- to monitor the cash flows of the private fund;

- to ensure that all cash has been booked in cash accounts opened in the name, or for the account, of the private fund; and

- to ensure that all payments made by investors in respect of investment interests have been received.

Identification of securities

A private fund that regularly trades securities or holds them on a consistent basis must maintain a record of the identification codes of the securities that it trades and holds and make this available to CIMA upon request.

Anti-Money Laundering

All investment funds are required to comply with Cayman Islands anti-money laundering legislation and regulations, including appointing an anti-money laundering compliance officer, a money laundering reporting officer, and a deputy money laundering reporting officer. The Cayman Islands government and CIMA actively work with the European Union, the Organisation for Economic Co-operation and Development, the Financial Action Task Force and regulators in numerous jurisdictions to observe and maintain international standards on transparency, and good corporate governance.

Further Assistance

This publication is not intended to be a substitute for specific legal advice or a legal opinion. If you require further advice relating to the matters discussed in this Briefing, please contact us. We would be delighted to assist.

E: gary.smith@loebsmith.com

E: robert.farrell@loebsmith.com

E: elizabeth.kenny@loebsmith.com

E: vanisha.harjani@loebsmith.com

E: vivian.huang@loebsmith.com

E: faye.huang@loebsmith.com

E: yun.sheng@loebsmith.com

We’re proud to be shortlisted at this year’s Private Equity Wire® US Awards 2025 in the following categories:

- Law Firm of the Year: Client Services Award

- Law Firm of the Year: Transactions Award

- Law Firm of the Year: Fund Structuring Award

- Law Firm of the Year: Overall Award

Please support the fantastic work of our Cayman Corporate/Funds Group by voting @LoebSmithAttorneys by Friday 5 September on this link: https://pew-awards.evalato.com/public-evaluation/19227/login

We are so excited to share that @LoebSmith has been shortlisted in three categories at the ALB Hong Kong Law Awards 2025, namely:

- Fintech Law Firm of the Year

- Investment Funds Law Firm of the Year

- Offshore Law Firm of the Year

The winners will be announced at the ceremony on 12 September 2025 in #HongKong.

Thank you all who contributed to this achievement!

Cayman Islands (29 July 2025) – Loeb Smith Attorneys, one of the leading offshore corporate law firms, acted as Cayman legal counsel to xTAO Inc. (“xTAO”) on its reverse merger and successful listing of its common share on Canada’s TSX Venture (TSXV) Exchange. Xtao’s common shares launched on TSXV at the market open on 23 July 2025, under the ticker symbol “XTAO.U”.

xTAO is a technology company focused exclusively on growing Bittensor and its decentralized AI ecosystem. Bittensor is a decentralized machine learning protocol that transforms machine intelligence into a tradable commodity by using its native token (TAO) for various purposes within the network. At its core, Bittensor is a platform built around incentives. Users contribute intelligence by helping AI systems improve and then earn TAO tokens based on the usefulness of the data or computational resources contributed to the network.

The listing coincides with xTAO’s closing of a US$22.8 million financing of subscription receipts from an array of leading venture capital firms in the digital asset industry, including Animoca Brands, Arca, Arche Capital, Borderless Capital, DCG, FalconX, Hypersphere Ventures, Off the Chain Capital, Republic and Stratos. The company will use the funds to expand its validator operations and build real-world products on top of Bittensor’s open network.

xTAO’s Founder, Karia Samaroo said “This listing marks an important milestone for xTAO in its commitment to advance the growth of decentralised AI. I really appreciated the clear advice, guidance and support of the Loeb Smith team throughout the entire process.”

The Loeb Smith team was led by Partner Gary Smith, and included team members Vivian Huang and Frost Wu.

Partner Gary Smith commented: “We are proud to have advised xTAO in this significant milestone. Their successful listing not only underscores the potential of decentralized technologies but also highlights the growing confidence in the digital asset space. Our firm’s extensive experience in navigating complex corporate transactions within the crypto market enables us to provide effective and strategic advice to innovative companies like xTAO. We look forward to seeing how xTAO will leverage this opportunity to innovate and contribute to the evolution of the Bittensor ecosystem.”

About Loeb Smith Attorneys

Loeb Smith Attorneys is one of the leading offshore corporate law firms considered one of the most active and knowledgeable firms for advising on offshore investment funds formation and launch of all asset classes including public securities, private equity, venture capital, real estate, and virtual assets. Other areas of strength and growth are advising on M&A, Finance, Corporate Restructurings, Capital Markets, Regulatory Compliance, Investments, Logistics, Shipping and Aviation.

Considered a leading law firm in the Fintech and Blockchain Technology space, Loeb Smith also advises on token issuances, application for VASP licences for Web 3.0 businesses, etaverse infrastructure and other virtual asset service providers, and utilising Cayman and BVI structures to develop virtual asset platforms for DAOs. Loeb Smith’s clients are investment managers, financial institutions, onshore counsels, and HNWIs who the firm advises on day-to-day legal issues and complex, strategic matters.

Some of our firm’s recent accolades are: rankings in IFLR1000, Legal 500; winning Best Law Firm – Fund Domicile at Hedgeweek US Emerging Manager Awards 2023 and 2024; winning Best Law Firm – Fund Domicile at Private Equity Wire US Emerging Manager Awards 2023 and 2024; winning Best Law Firm – Fund Domicile at Private Equity Wire US Awards 2023; recognised amongst Top 30 Asia’s Fastest Growing Law Firms in 2023, 2024 by Asian Legal Business; ranked in The A-List: Top Offshore Lawyers by Asia Business Law Journal in 2022 and 2024; winning The Best Offshore Law Firm – Client Service at With Intelligence HFM Asia Services Awards 2024; ranked in ALB Hong Kong Firms to Watch 2024, 2025 lists.

www.loebsmith.com

BRITISH VIRGIN ISLANDS | CAYMAN ISLANDS | HONG KONG