About Loeb Smith

People

Sectors

Expertise

- Legal Service

- Banking and Finance

- Blockchain, Fintech and Cryptocurrency

- Capital Markets and Privatization

- Corporate

- Cybersecurity and Data Privacy

- Insolvency, Restructuring and Corporate Recovery

- Insurance and Reinsurance

- Intellectual Property

- Investment Funds

- Litigation and Dispute Resolution

- Mergers and Acquisitions

- Private Client and Family Office

- Private Equity and Venture Capital

- Governance, Regulatory and Compliance

- Entity Formation and Managed Services

- Consulting

- Legal Service

News and Announcements

Locations

Subscribe Newsletters

Contact

BVI: Conversion of Incubator Funds and Approved Funds and ongoing requirements

13 October 2025 . 6 min readIntroduction

Among the many investment fund structures provided by the Financial Services Commission (“FSC”) of the British Virgin Islands (“BVI”) under the Securities and Investment Business Act (As Revised) of the BVI, Approved Funds and Incubator Funds have for a number of years been very attractive options for Start-up Fund Managers and Emerging Fund Managers. Introduced in 2015 by the BVI’s Securities and Investment Business (Incubator and Approved Funds) Regulations (the “Regulations”), these two open-ended fund structures offer reduced regulatory burden and lower operational costs for Fund Managers to test their investment strategies and abilities. Recognising the inherent limitations of these two fund structures, there are built-in provisions in the Regulations that allow for and facilitate conversion into more robust fund structures (i.e. Private Fund or Professional Fund) upon specific trigger events.

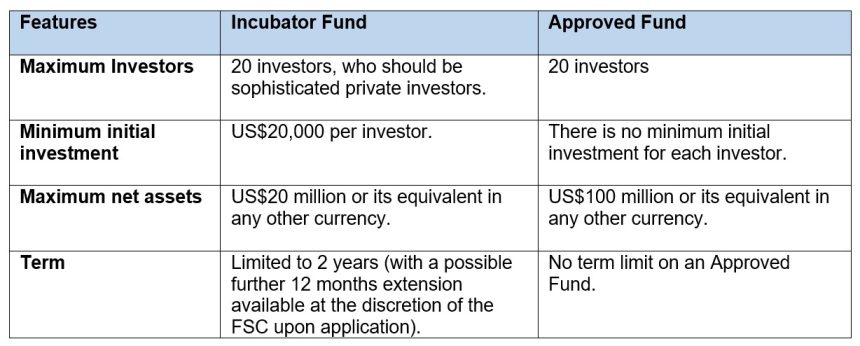

In our previous Legal Briefings, we have discussed in detail the key features and benefits of Incubator Funds and Approved Funds Key Features and Benefits of the BVI Incubator Fund | Loeb Smith, Key Features and Benefits of a BVI Approved Fund | Loeb Smith. As a recap, we set out below the key features of these two categories of BVI funds.

Trigger Events for Conversion

Trigger events are directly linked to the key features of these funds. For an Incubator Fund, the most common triggering event for conversion is the expiration of its Term. At the end of the initial 24 months (“Validity Period”) of the Term, there is a decision to be made in terms of whether the Incubator Fund wishes to terminate its business or continue operation as an investment fund. The other triggering events include (i) the total number of investors close to exceeding 20 and (ii) the net assets exceeding US$20 million over a period of two consecutive months.

For an Approved Fund, as there is no limit on the Term for the Approved Fund, the only triggering events for conversion are the total number of investors exceeding 20 or the net assets exceeding US$100 million over a period of two consecutive months.

When and how to apply for conversion?

Incubator Fund

Upon occurrence of a triggering event, if the Incubator Fund decides to continue its operation as a mutual fund, an application for conversion must be submitted by the Incubator Fund to convert into and be recognised as a Private Fund or a Professional Fund or be approved as an Approved Fund either at least 2 months before the expiry of its Validity Period, or within 7 days after the end of the second month where its number of investors or the net assets exceed the threshold.

In the application, the Incubator Fund should:

-

-

- complete the application form and submit the updated fund documentation for the Fund to be recognised as a Private Fund or a Professional Fund or be approved as an Approved Fund;

- if the Incubator Fund intends to be converted into a Private Fund or a Professional Fund, prepare and submit to the FSC an audit of its (i) current financial position; and (ii) compliance with the requirements of the Regulations. The aforesaid audit should be performed by either a person approved by the FSC under SIBA or pursuant to section 56 of the Regulatory Code, 2009, as an auditor, or a person, if not an approved auditor, who is independent of the Incubator fund and whose normal duties include the performance of such an independent audit function; and

- in case of conversion to a Private Fund or Professional Fund, appoint an auditor, a fund manager, and a custodian pursuant to Mutual Funds Regulations (As Revised) of the BVI (the “MFR”) if it does not have these roles already filled (which in most cases it will not have had filled as they are not compulsory for an Incubator Fund). It may apply for exemption from the custodian or fund manager requirement along with the conversion application.

-

Where an Incubator Fund converts into an Approved Fund, the existing sophisticated private investors in the Incubator Fund shall be treated like any other investor in the Approved Fund.

Where an Incubator Fund converts into a professional fund, the existing investors are grandfathered and do not need to comply with the minimum initial investment amount requirement of US$100,000. This requirement would only apply to new incoming investors.

Approved Fund

Similar to the Incubator Fund, upon a triggering event, if the Approved Fund decides to continue its operation as a mutual fund, an application for conversion must be submitted by the Approved Fund to the FSC to convert into and be recognised as a Private Fund or Professional Fund within 7 days of the end of the second month where its total number of investors or the net assets exceed the threshold.

When filing the application, the Approved Fund should:

-

-

- complete the applicable application form and submit the updated fund documentation for the Fund to the FSC to be recognised as a Private Fund or Professional Fund; and

- appoint the auditor, the fund manager, the fund administrator and the custodian, or apply for applicable exemptions as mentioned above.

-

Different to that for an Incubator Fund, an Approved Fund is not, at the time of applying for conversion, subject to a statutory requirement to submit an audit of its current financial position and compliance with the Regulations.

If the Approved Fund converts into a Professional Fund, each investor is required to demonstrate that it is a professional investor and has a minimum investment amount of US$100,000. There is no exemption for existing investors as in the case of an Incubator Fund.

The Incubator Fund or the Approved Fund should notify all of its investors of the conversion and keep them informed about the proposed change of regulatory status. The FSC may also raise queries about the details of the trigger event and the current circumstances of the Fund.

Options other than conversion

When a trigger event occurs, if the Incubator Fund or Approved Fund decides not to proceed with conversion as discussed above, under the Regulations, it should:

-

-

- commence the process for a voluntary liquidation under the BVI Business Companies Act (As Revised); or

- take necessary steps to amend its constitutional documents to cease to be a Fund and remove all references from its constitutional documents to being an Incubator Fund or Approved Fund (as applicable).

-

This publication is not intended to be a substitute for specific legal advice or a legal opinion. For specific advice on the matters covered in this Legal Insight, please contact your usual Loeb Smith attorney or any of the following:

E: gary.smith@loebsmith.com

E: robert.farrell@loebsmith.com

E: elizabeth.kenny@loebsmith.com

E: vanisha.harjani@loebsmith.com

E: frost.wu@loebsmith.com

Latest Updates and Insights

INSIGHTS | 09 January 2026

Private Funds in the Cayman Islands

This article will provide a general overview of the steps involved in the formation and running of a closed-ended investment fund in the Cayman Islands pursuant to the Private Funds Act (As Revised) (the “Act”). Whilst there are no statutory requirements as to the type of legal entity...

INSIGHTS | 16 December 2025

The Cayman Islands Implements Crypto-Asset Reporting Framework

The Common Reporting Standard (“CRS”) which was published by The Organisation for Economic Co-operation and Development (“OECD”) is intended to, among other things, improve international tax transparency. The CRS achieves this objective by, among other things, requiring committed jurisdictions to obtain information on offshore accounts held with “Financial...

INSIGHTS | 03 November 2025

Granting and Protecting Security Over Shares in a Cayman Islands Exempted Company

Cayman Islands exempted companies are widely utilized in structuring cross-border finance transactions. One of the key reasons for this is that the Cayman Islands provides a flexible and well-tested regime for secured financing transactions that is attractive to borrowers and lenders alike. The process for creating security in...

INSIGHTS | 28 October 2025

Effectiveness and Role of the Letter of Wishes in Trusts

Effectiveness and Role of the Letter of Wishes in Trusts