Incorporate Your Idea. How to Develop Your Intellectual Property in the Cayman Islands

26 July 2018

Introduction

The Cayman Islands have taken significant steps in recent years to update and modernize the legal framework with respect to protection of intellectual property (IP). Traditionally, the Cayman Islands patents and trademarks registry only served to extend rights which had previously been registered in the U.K. or the European Union. However, in addition to an overhaul of the copyright laws earlier this year1, lawmakers are currently in the process of modernizing the patents and trademarks laws2 to encourage growth of the IP-intensive industries.

While the patent rules will only be slightly amended to be more protective of innovators3, the most significant reform is the creation of a new stand-alone trademark system for the Cayman Islands which would not require a first registration in the U.K. or at the European Union level4. Finally, companies will also be able to extend protection of their industrial design rights in the Cayman Islands.

The Cayman Islands aim to become an important offshore hub for the development and commercial exploitation of IP

IP encompasses inventions, literary and artistic works, symbols, names and images used in commerce, and is currently the most important assets of many technology and industrial companies. The ability to protect and maximize the value of IP assets is therefore of strategic importance and often is one of the main factors which contribute to a company's growth.

According to the most recent statistics from the WIPO IP Statistics Data Center, global patent applications in 2015 rose to 2.9 million, with more than 1 million inventions coming from China, while trademark applications reached about 6 million, almost half of them filed by Chinese companies. In a report from the U.S. Department of Commerce published in September 2016, more than 25% of the existing industries in the United States were defined as "IP-intensive", and in 2014 they already accounted for more than a third of the total GDP of the United States.

Largely known as one of the premier offshore financial centres for hedge funds and other investment vehicles, Cayman is now trying to become a popular destination for IP migration but also development5. Businesses in areas related to innovation and technology can now be established in Cayman under the special rules of the Special Economic Zone (SEZ). The SEZ now includes more than 180 tech and knowledge-based companies and is rapidly growing due to entrepreneurs realizing that Cayman is a very attractive place to house IP-intensive businesses.

In the first of our series of legal insights on owning IP through a Cayman Islands structure, we will explore some of the key benefits of incorporating an exempted company as part of the SEZ.

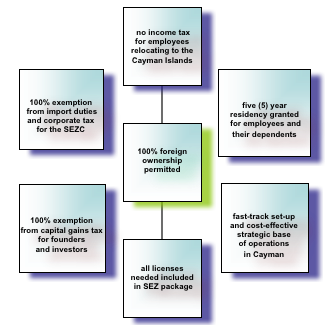

Key Benefits of being in the Cayman Islands Special Economic Zone (SEZ)

For many of the IP-intensive industries, intangibles are the only fixed assets on a company's balance sheet. Technology and media businesses develop their customer base all over the world. Such companies often start small, with a team of talented and dedicated people, and in their growing stage may be attracted to relocating in the Cayman Islands6 to benefit from its stable yet business-friendly legal framework.

The Cayman Islands exempted company is the preferred corporate structure for such businesses (no regulatory approvals, no need for resident directors, no requirement for an annual audit, and no need for an annual shareholders' meeting).

In addition, the existing or newly incorporated exempted company may apply to be registered as a Special Economic Zone Company (SEZC), allowing it to benefit from specific advantages such as speeding up very significantly work permit applications for the employees to be relocated to the Cayman Islands or access to very good infrastructure and support services. The SEZ, offering a lean, flexible and tax-friendly regulatory environment in an all-inclusive package, often gives talented inventors and entrepreneurs the best solutions for growth.

Businesses in the following sectors may qualify to set up as an SEZC:

- Commodities & Derivatives

- Media & Marketing

- Internet & Technology

- Biotechnology

- Education & Training

Additional advantages of incorporating a Cayman exempted company

-

No Prohibition on Financial Assistance

There is no prohibition in the Cayman Islands for an exempted company to provide financial assistance with regard to the acquisition of its own shares. This provides the founders of a company with significantly more flexibility to structure a deal to buy out a previous shareholder for example without the need to find a third party investor or to become extremely indebted. (The directors of the company owe however a fiduciary duty to the company to act in good faith in the best interests of the company in agreeing to provide the financial assistance.)

-

No Taxes on Income, Disposal of IP Assets or Capital Gains

Remunerations paid to the employees and distributions to shareholders are not subjected to any tax in the Cayman Islands. There are also no taxes for the corporate income or any registration taxes or stamp duty to be paid on the transfer of shares (other than in relation to the transfer of shares in a company which holds real estate in the Cayman Islands).

-

More Flexibility for Distributions

Under the Cayman Islands Companies Law, the company has a greater latitude in distributing profits as dividends. For example, a sale of a portion of the IP assets could result in a dividend distribution, but also a simple revaluation of the IP assets on the balance sheet (provided that the valuation is not speculative). Also, the company is permitted to use its share premium account to fund the payment of dividends (provided that the company remains solvent thereafter).

-

IP Protected by Commercial Confidentiality

The accounts and financial statements of the Cayman Islands exempted company are not filed or published and the corporate documents are not available to inspection by the public, therefore providing a high degree of commercial confidentiality, which is often critical for IP asset protection. Before the company reaches critical mass and is ready to go public, no competitor will be able to glean any information from management reports or financial statements.

This Guidance Note is not intended to be a substitute for specific legal advice or a legal opinion. It deals in broad terms only and is intended to merely provide a brief overview and general guidance only. For more specific advice please refer to your usual Loeb Smith contact or:

E [email protected]

E [email protected]

E [email protected]

E [email protected]

© Loeb Smith Attorneys, 2018

www.loebsmith.com

1. The Copyright (Cayman Islands) Order 2015 and the Copyright (Cayman Islands) (Amendment) Order, 2016 (collectively, the Copyright Orders) extend most of the current U.K. copyright law to the Cayman Islands.

2. Currently in the process of being adopted are The Patents and Trade Marks (Amendment) Bill, 2016 and The Trade Marks Bill, 2016.

3. The proposed reform aims to encourage innovation by dissuading "patent trolls" - the new law will specifically prohibit or at least discourage "assertions of patent infringement which are made in bad faith".

4. To apply the new IP rules, the Cayman Islands have also established the Cayman Islands Intellectual Property Office (CIIPO) as a separate section of the Cayman Islands Government's General Registry Department, as well as a separate Intellectual Property Law Gazette.

5. Over the last 30 years, larger multinational companies (especially Fortune 1000 companies) have been migrating IP to lower-tax jurisdictions benefiting from double taxation treaties (such as Ireland, Switzerland, Netherlands, Singapore, etc.) as part of their tax optimization strategy. The IP would be developed in high-tax jurisdictions allowing the taxpayer to incur deductible losses and expenses, and then transferred abroad when it became an income-producing asset. This practice has been, however, increasingly challenged by tax authorities all over the world.

6. The Cayman Islands Companies Law allows for the registration (called transfer by continuation) of a company with limited liability and share capital incorporated in a foreign jurisdiction (provided that the laws of such foreign jurisdiction do not prohibit the relocation).

Recent News & Publications

27 Mar 2024

Captive Insurance In The Cayman Islands

By Gary Smith, Partner, Loeb Smith, Cayman Islands

By Robert Farrell, Partner, Loeb Smith, Cayman Islands

A captive insurance company is a wholly-owned subsidiary insurer that provides risk mitigation services for its parent company or related...

Read More

27 Mar 2024

Captive Insurance In The Cayman Islands

By Gary Smith, Partner, Loeb Smith, Cayman Islands

By Robert Farrell, Partner, Loeb Smith, Cayman Islands

A captive insurance company is a wholly-owned subsidiary insurer that provides risk mitigation services for its parent company or related...

Read More

22 Mar 2024

Key factors for launching a virtual assets business in the BVI

The British Virgin Islands (“BVI”) continues to attract virtual assets businesses seeking to capitalize on its status as a leading offshore financial centre.

Read More

22 Mar 2024

Key factors for launching a virtual assets business in the BVI

The British Virgin Islands (“BVI”) continues to attract virtual assets businesses seeking to capitalize on its status as a leading offshore financial centre.

Read More